Unlock Accounting Like a Pro!

Confused why some accounts get debited while others get credited? Every financial transaction follows 3 simple Golden Rules. Think of them as your GPS for navigating accounting – they tell you exactly where to record money coming in or going out. Let’s break them down step-by-step!

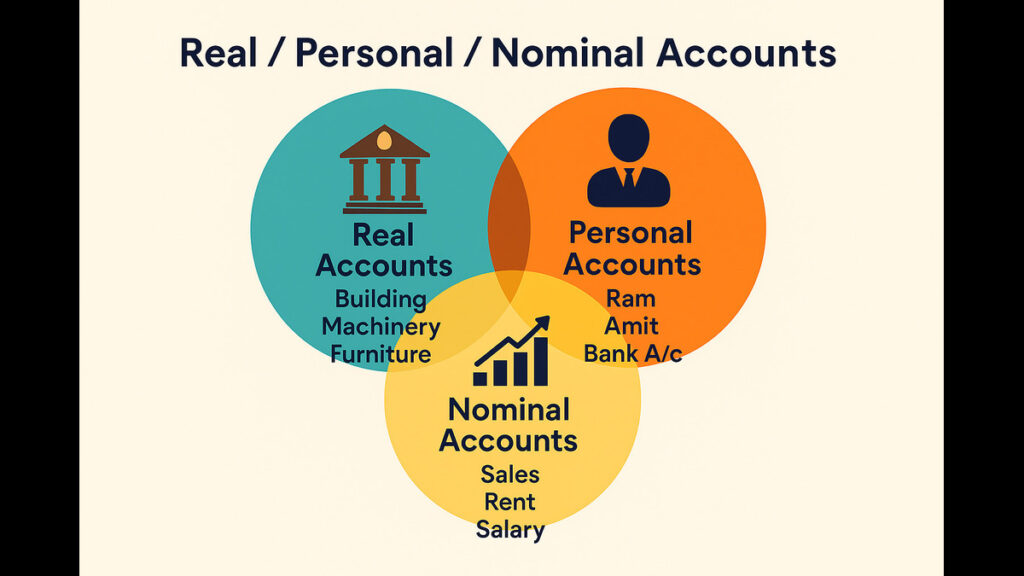

Understanding the 3 Account Types

(Before learning rules, know what you’re recording!)

🏠 Real Accounts: The “What” of Business

- What they track: Physical and non-physical assets owned by the business

- Examples:

- Cash in hand 💵

- Computers and furniture 🖥️

- Buildings and land 🏢

- Patents and trademarks

- Key feature: These accounts stay with the business year after year

👥 Personal Accounts: The “Who” of Business

- What they track: People and organizations you deal with

- Examples:

- Customers who owe you money (Debtors) 👨💼

- Suppliers you owe money to (Creditors) 👩💼

- Banks 🏦

- Tax authorities 🏛️

- Key feature: They represent relationships

📊 Nominal Accounts: The “Why” of Business

- What they track: Profits, losses, incomes and expenses

- Examples:

- Sales revenue 📈

- Rent and electricity bills 📉

- Salary expenses 👔

- Interest earned 💰

- Key feature: Reset to zero every accounting year

The 3 Golden Rules Demystified

Rule 1: For Real Accounts

“Debit what comes IN, Credit what goes OUT”

Why this works: Real accounts track assets. When assets enter the business, they increase – so we debit. When assets leave, they decrease – so we credit.

🖨️ Detailed Example: Purchased printer for ₹20,000 cash

- Printer COMES IN → Debit Printer Account (asset increases)

- Cash GOES OUT → Credit Cash Account (asset decreases)

text

Copy

Download

Printer A/c Dr. 20,000

To Cash A/c 20,000

(Being printer purchased for cash)

💡 Pro Tip: Works for ALL assets – whether buying computers, land, or patents!

Rule 2: For Personal Accounts

“Debit the RECEIVER, Credit the GIVER”

Why this works: In any transaction between two parties, one receives benefit (debit) while the other gives benefit (credit).

📦 Detailed Example: Sold goods worth ₹50,000 to Raj Stores on credit

- Raj Stores (Receiver) gets goods → Debit Raj Stores Account

- Your business (Giver) provides goods → Credit Sales Account

text

Copy

Download

Raj Stores A/c Dr. 50,000

To Sales A/c 50,000

(Being goods sold on credit to Raj Stores)

💡 Real-life Connection:

- When you borrow money: Bank (GIVER) is credited, your Loan (RECEIVER) is debited

- When you pay supplier: Supplier (RECEIVER) is debited, Cash (GIVER) is credited

Rule 3: For Nominal Accounts

“Debit ALL Expenses/Losses, Credit ALL Incomes/Gains”

Why this works: Expenses decrease business value (debit), while incomes increase value (credit).

💸 Detailed Example 1: Paid ₹8,000 mobile bill

- Mobile expense (Loss) → Debit Mobile Expense Account

- Cash (Asset going out) → Credit Cash Account

text

Copy

Download

Mobile Expense A/c Dr. 8,000

To Cash A/c 8,000

(Being mobile bill paid)

📈 Detailed Example 2: Earned ₹6,000 interest from bank

- Cash (Asset coming in) → Debit Cash Account

- Interest income (Gain) → Credit Interest Received Account

text

Copy

Download

Cash A/c Dr. 6,000

To Interest Received A/c 6,000

(Being interest received from bank)

How These Rules Solve Real Problems

Case Study: Buying Goods on Credit

Transaction: Purchased goods worth ₹1,00,000 from Mehta Suppliers on credit

- Identify accounts:

- Mehta Suppliers (Personal Account – Creditor)

- Purchases Account (Nominal Account – Expense)

- Apply rules:

- Rule 2: Mehta Suppliers (GIVER) → Credit

- Rule 3: Purchases (Expense) → Debit

text

Copy

Download

Purchases A/c Dr. 1,00,000

To Mehta Suppliers A/c 1,00,000

(Being goods purchased on credit from Mehta Suppliers)

💥 Exam Hack:

When confused, ask these 3 questions:

- Is this an asset? → Use Rule 1

- Is this a person/company? → Use Rule 2

- Is this income/expense? → Use Rule 3

Your Golden Rules Cheat Sheet

| Situation | Account Type | Rule | Action |

|---|---|---|---|

| Bought furniture cash | Real (Furniture) | Comes IN | Debit ✔️ |

| Paid salary | Nominal (Expense) | Expenses | Debit ✔️ |

| Received loan from bank | Personal (Bank) | GIVER | Credit ✔️ |

| Sold goods to Rohan | Personal (Rohan) | RECEIVER | Debit ✔️ |

| Interest income received | Nominal (Income) | Incomes | Credit ✔️ |

Master These Rules in 3 Days!

- Day 1: Practice only cash transactions

- Focus on Rules 1 (Real) and 3 (Nominal)

- Day 2: Practice credit transactions

- Focus on Rules 2 (Personal) and 3 (Nominal)

- Day 3: Practice mixed transactions

- Combine all three rules

Golden Mantra:

“When asset enters – Debit it!

When expense occurs – Debit it!

When someone receives – Debit them!

Reverse for credits – Apply this logic!”