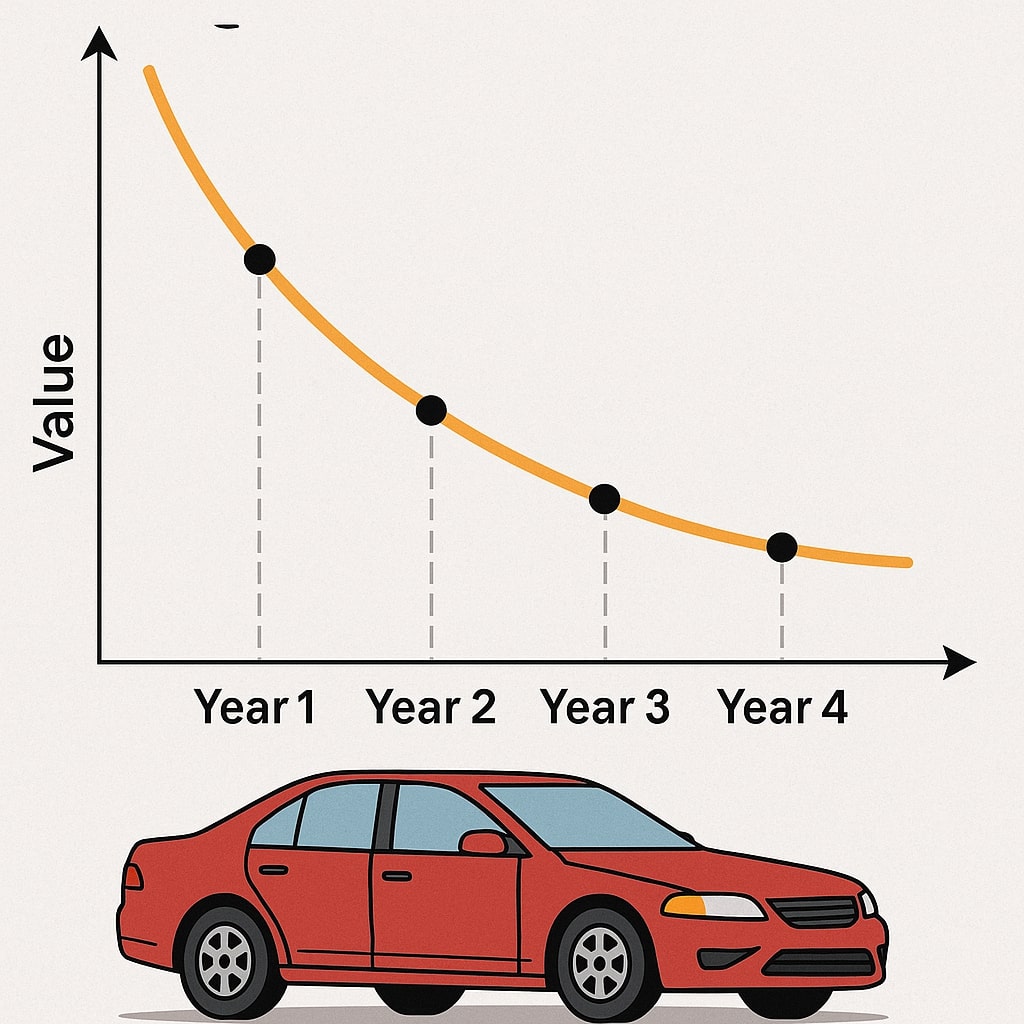

What is Depreciation? The Lemon Car Story 🍋🚗

magine buying a brand-new car for ₹5,00,000. After 1 year, it’s worth ₹4,00,000. After 5 years, maybe ₹2,00,000. This value drop? That’s depreciation!

In Simple Terms:

Depreciation = Cost of Asset – Scrap Value

Spread over the asset’s life

Why it matters:

- Shows true profit (revenue – expenses)

- Displays accurate asset value in balance sheet

- Tax savings (depreciation is tax-deductible)

Two Main Methods: Meet SLM & DBM!

Think of depreciation methods like two ways to eat a chocolate bar:

| Method | Straight Line (SLM) | Diminishing Balance (DBM) |

|---|---|---|

| Style | Equal bites every day | Big bites first, small later |

| Best For | Buildings, furniture | Phones, cars, machinery |

| Calculation | Simple division | Percentage of remaining value |

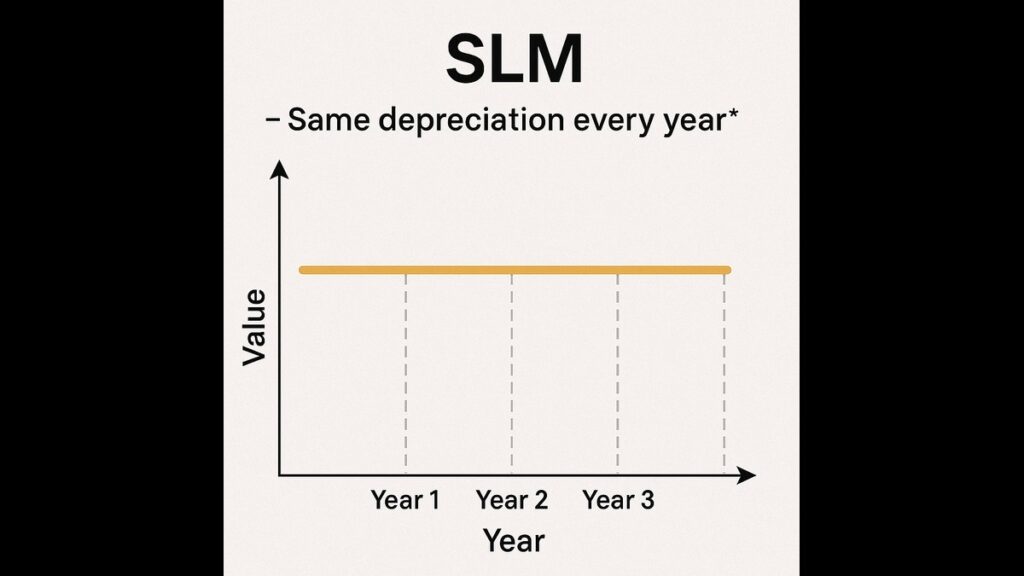

1. Straight Line Method (SLM): The Easy One!

How it works:

- Same depreciation amount every year

- Simple formula:

text

Copy

Download

Annual Depreciation = (Cost - Scrap Value) ÷ Useful Life

Example: Buying a printer for your college project:

- Cost: ₹20,000

- Scrap Value (after 5 yrs): ₹5,000

- Useful Life: 5 years

Calculation:

text

Copy

Download

= (20,000 - 5,000) ÷ 5 = ₹3,000 per year

Yearly Breakdown:

| Year | Depreciation | Remaining Value |

|---|---|---|

| 1 | ₹3,000 | ₹17,000 |

| 2 | ₹3,000 | ₹14,000 |

| 3 | ₹3,000 | ₹11,000 |

| 4 | ₹3,000 | ₹8,000 |

| 5 | ₹3,000 | ₹5,000 (scrap) |

✅ SLM = Equal slices every year!

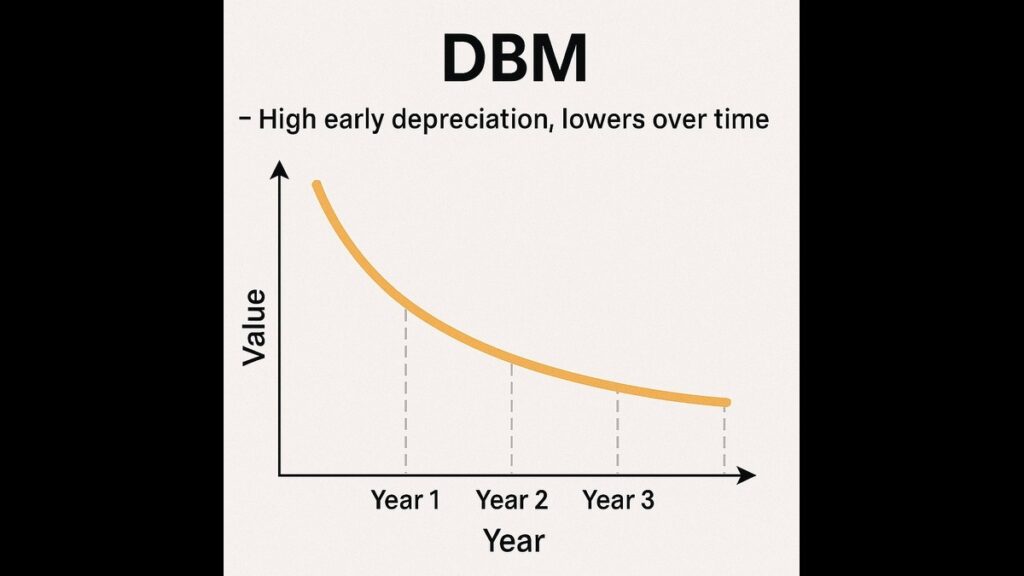

2. Diminishing Balance Method (DBM): The Front-Loaded Way!

How it works:

- Higher depreciation in early years

- Lower depreciation later

- Formula:

text

Copy

Download

Annual Depreciation = Current Value × Fixed %

Example: Same ₹20,000 printer

- Depreciation Rate: 30% per year

Yearly Breakdown:

| Year | Start Value | Depreciation (30%) | End Value |

|---|---|---|---|

| 1 | ₹20,000 | ₹6,000 (30% of 20k) | ₹14,000 |

| 2 | ₹14,000 | ₹4,200 (30% of 14k) | ₹9,800 |

| 3 | ₹9,800 | ₹2,940 (30% of 9.8k) | ₹6,860 |

| 4 | ₹6,860 | ₹2,058 | ₹4,802 |

| 5 | ₹4,802 | ₹1,441 | ₹3,361 |

✅ DBM = Big bites first, small bites later!

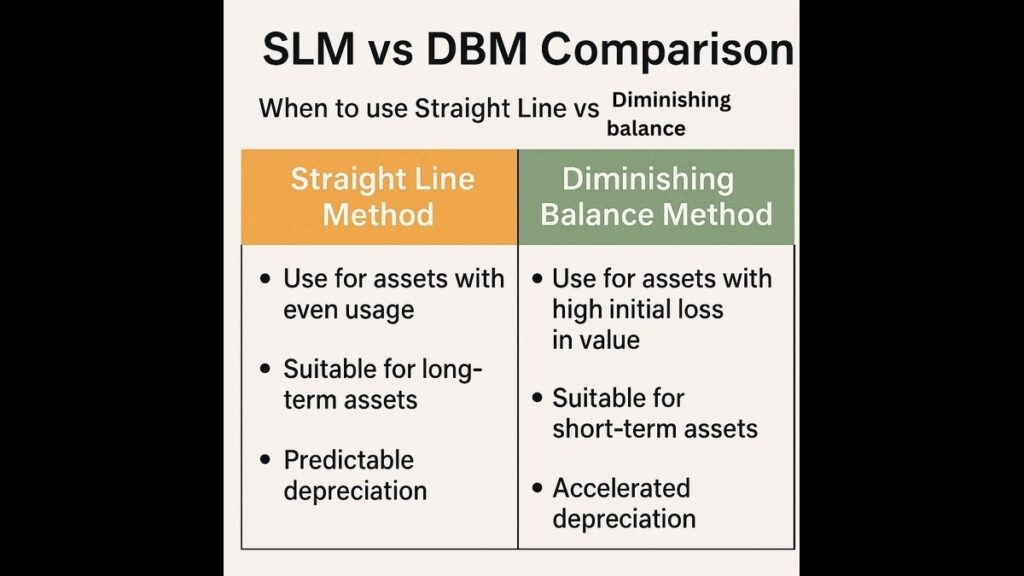

SLM vs DBM: Which to Use?

Choose SLM when:

- Asset loses value evenly (like furniture)

- You want simple calculations

- Scrap value is predictable

Choose DBM when:

- Asset loses value fast initially (like phones)

- You want tax benefits early

- Technology becomes outdated quickly

Real-Life Examples:

| Asset | Best Method | Why? |

|---|---|---|

| Office Building | SLM | Ages evenly |

| Laptop | DBM | Loses value fast |

| Printer | SLM | Simple to calculate |

Practice Problems (Solve Like a Pro!)

Problem 1 (SLM):

You buy a camera for ₹50,000.

Useful life: 5 years

Scrap value: ₹10,000

Calculate yearly depreciation.

Solution:

text

Copy

Download

= (50,000 - 10,000) ÷ 5 = ₹8,000 per year

Problem 2 (DBM):

A machine costs ₹1,00,000.

Depreciation rate: 25%

Calculate depreciation for Year 1 & 2.

Solution:

- Year 1: 1,00,000 × 25% = ₹25,000

- Year 2: (1,00,000 – 25,000) × 25% = ₹18,750

3 Exam Golden Rules

- SLM Formula:(Cost – Scrap Value) ÷ Years

- DBM Formula:Current Value × %

- Scrap Value:

- Always subtract in SLM

- Not subtracted in DBM (uses percentage)

Why This Matters in Real Life

- Businesses: Show true profits

- Tax Savings: Higher depreciation = lower taxable income

- Investors: See accurate company value

💡 Fun Fact: Companies switch methods to save taxes!

Conclusion

Master both methods to:

- Ace accounting exams 📚

- Make smart business decisions 💼

- Save money on taxes 💸

Final Tip: In exams, ask: “Is the asset losing value evenly or fast initially?” That decides SLM or DBM!