(For FYBCom Students & Future Accountants!)

Meet Rohan: The Café Owner ☕

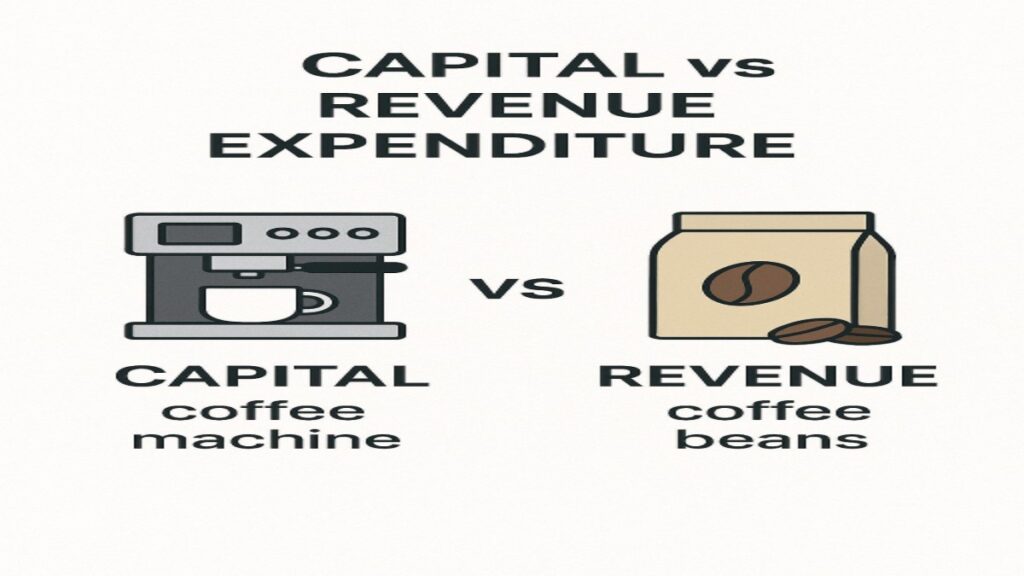

Rohan spends money in two ways:

- One-Time Big Purchases:

- ₹5 Lakhs coffee machine

- ₹3 Lakhs furniture

→ Capital Expenditure

- Daily Running Costs:

- ₹10,000/month coffee beans

- ₹8,000/month electricity

→ Revenue Expenditure

Why care? Mixing these = Wrong profits, wrong taxes, exam mistakes!

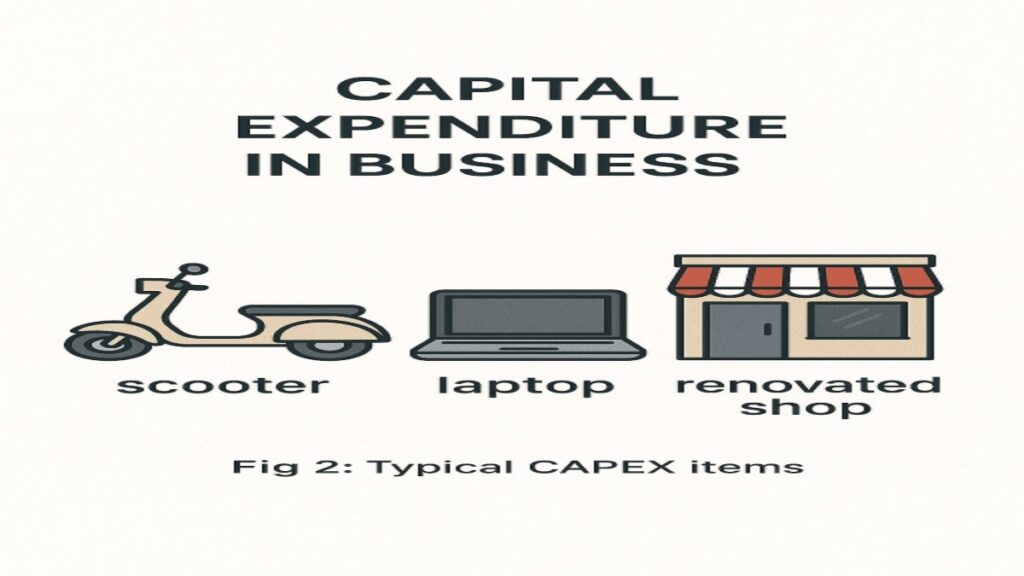

1. Capital Expenditure (CAPEX)

What it is:

Money spent to buy or upgrade assets used for years.

Examples:

| Item | Why CAPEX? |

|---|---|

| Delivery Scooter | Used for 5+ years |

| Laptop for billing | Lasts 3-4 years |

| Shop Renovation | Benefits long-term |

Accounting Magic:

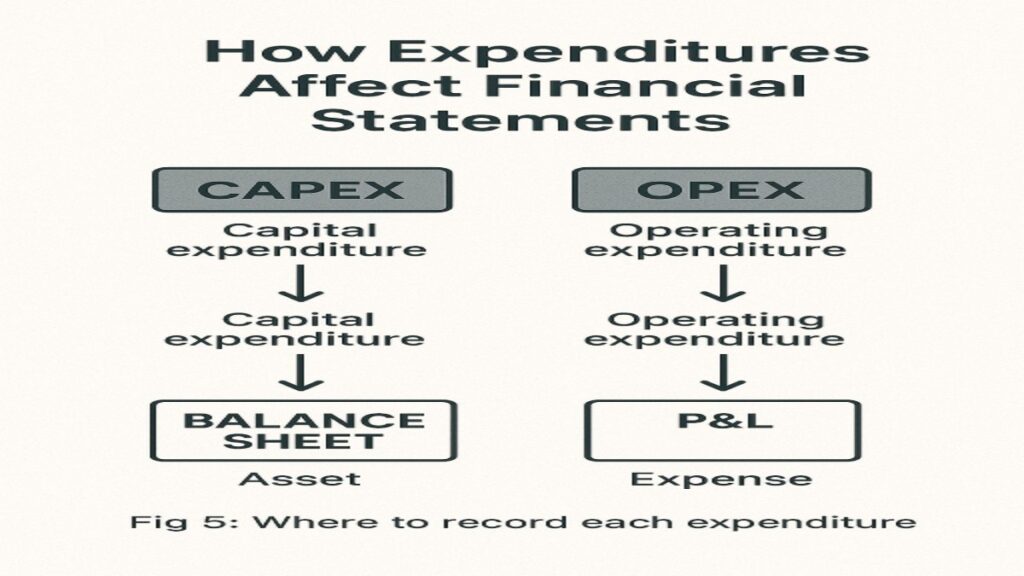

- Appears in Balance Sheet (as asset)

- Depreciated yearly (value reduced gradually)

💡 Student Tip:

Think: “Is this a long-term friend?” → If yes, CAPEX!

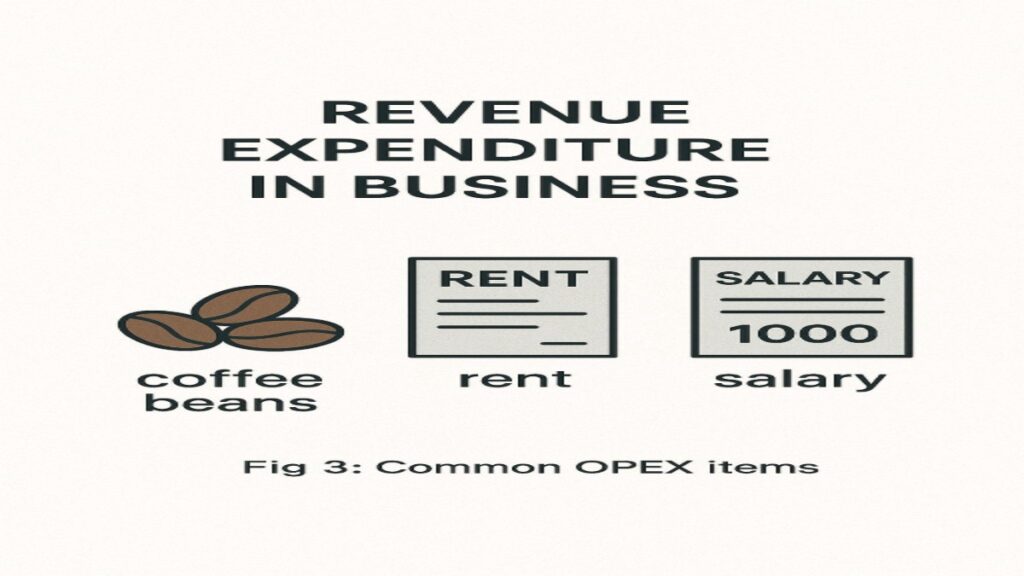

2. Revenue Expenditure (OPEX)

What it is:

Money spent for daily operations to earn income now.

Examples:

| Item | Why OPEX? |

|---|---|

| Coffee Beans | Used up immediately |

| Monthly Rent | Recurring cost |

| Staff Salaries | Paid every month |

Accounting Magic:

- Appears in Profit & Loss Account

- Fully deducted in same year

💡 Student Tip:

Think: “Is this a daily need?” → If yes, OPEX!

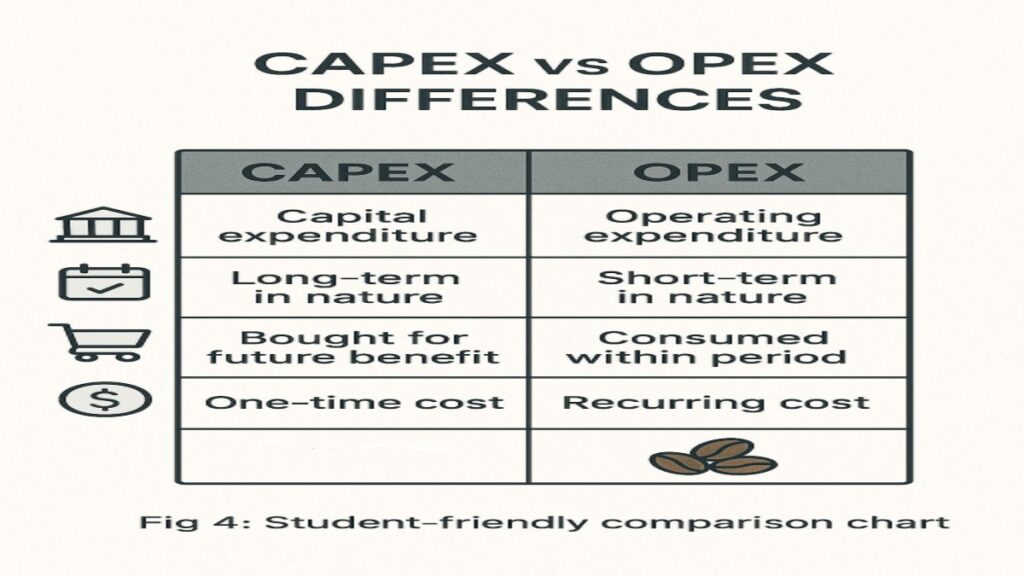

Key Differences: CAPEX vs OPEX Cheat Sheet

| Test | Capital Expenditure | Revenue Expenditure |

|---|---|---|

| Time | Benefits >1 year | Benefits ≤1 year |

| Value | Usually high (₹10k+) | Usually low (daily costs) |

| Frequency | One-time purchase | Recurring expense |

| Where Recorded | Balance Sheet | Profit & Loss Account |

| Tax Benefit | Claim depreciation yearly | Deduct fully in same year |

Image 4: Comparison Chart

Real-Life Cases (For Exams!)

Case 1: Computer Purchase

- ₹40,000 laptop for business → CAPEX

(Balance Sheet Asset → Depreciated over 4 years)

Case 2: Printer Repair

- ₹2,000 to fix paper jam → OPEX

(Full expense in P&L this year)

Case 3: Software Upgrade

- ₹15,000 for new features →

- If extends software life → CAPEX

- If routine update → OPEX

Accounting Entries Simplified

CAPEX Entry

Rohan buys ₹5 Lakhs coffee machine:

text

Copy

Download

Coffee Machine A/c Dr. 5,00,000

To Bank A/c 5,00,000

(Appears in Balance Sheet as Asset)

OPEX Entry

Rohan pays ₹20,000 electricity bill:

text

Copy

Download

Electricity A/c Dr. 20,000

To Bank A/c 20,000

(Appears in P&L Account as Expense)

Image 5: Accounting Impact

Test Yourself! (Answers Below)

- ₹50,000 for AC in office → ❓

- ₹10,000 monthly internet bill → ❓

- ₹2 Lakhs for trademark → ❓

- ₹5,000 for printer ink → ❓

- ₹7 Lakhs delivery van → ❓

Answers:

- CAPEX (Long-term use)

- OPEX (Recurring cost)

- CAPEX (Intangible asset)

- OPEX (Daily consumable)

- CAPEX (Lasts years)

Why This Matters?

- Exams: 30% of accounting questions

- Business: Impacts profit calculation

- Taxes: Wrong classification = penalties!

💼 Real Impact:

Treating ₹5 Lakhs machine as OPEX → Profit understated by ₹5 Lakhs!

3 Golden Rules for Exams

- Duration Test:Benefit >1 year? → CAPEX

- Recurrence Test:Monthly payment? → OPEX

- Value Test:Big amount? → Usually CAPEX

Conclusion

Master CAPEX vs OPEX to:

- Score 90%+ in exams 📚

- Avoid accounting mistakes 💼

- Understand business finances 🚀

Start Today: Classify your monthly expenses as CAPEX/OPEX