🌟 Meet the Auditor’s Three Superpowers

Think of auditing like checking your friend’s vacation story:

📸 Vouching = “Show me your ticket stubs!”

👀 Verification = “Prove you actually visited that place!”

💰 Valuation = “Is that souvenir really worth ₹5,000?”

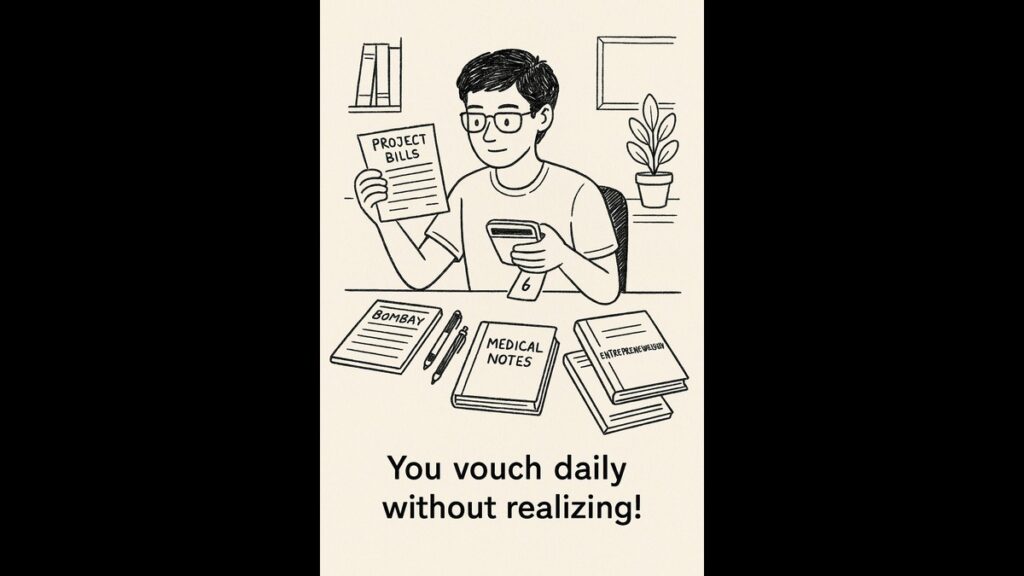

📑 1. Vouching: The “Receipt Checker”

(Like verifying your project expenses!)

What it means:

Checking if transaction documents support what’s recorded in books.

How it works:

plaintext

Copy

Download

Company: "We spent ₹10,000 on office chairs" ↓ Auditor: "Show me: 1. Purchase invoice 2. Payment proof 3. Delivery note"

Real Examples:

- Sales → Sales bill + Shipping proof

- Rent paid → Rent receipt + Bank transaction

- Salary → Salary slip + Bank transfer

Why it matters:

❌ No vouching? → Fake expenses like “Office party ₹50,000” (never happened!)

🔎 2. Verification: The “Existence Inspector”

(Like checking your college lab equipment!)

What it means:

Confirming assets physically exist and belong to the company.

Auditor’s 3 Questions:

- Is it REAL? → Count stock, visit property

- Who OWNS it? → Check ownership papers

- Is it DAMAGED? → Inspect condition

Critical for:

- Buildings 🏢

- Machinery 🛠️

- Inventory 📦

- Investments 📈

Shocking Truth:

One company showed 10 delivery vans → Auditor found only 4!

💰 3. Valuation: The “Price Detective”

(Like selling your old textbooks!)

What it means:

Checking if assets are recorded at correct value.

Valuation Rules:

| Asset | Rule | Example |

|---|---|---|

| Computers | Cost – Depreciation | ₹50,000 laptop → ₹15,000 after 3 years |

| Inventory | Lower of cost or market price | Bought pens ₹10 → Now ₹7 → Value at ₹7 |

| Investments | Current market price | Shares bought at ₹100 → Now ₹120 → Value ₹120 |

Why it matters:

❌ Overvalued assets = Fake company health report

❌ Undervalued loans = Hidden debts

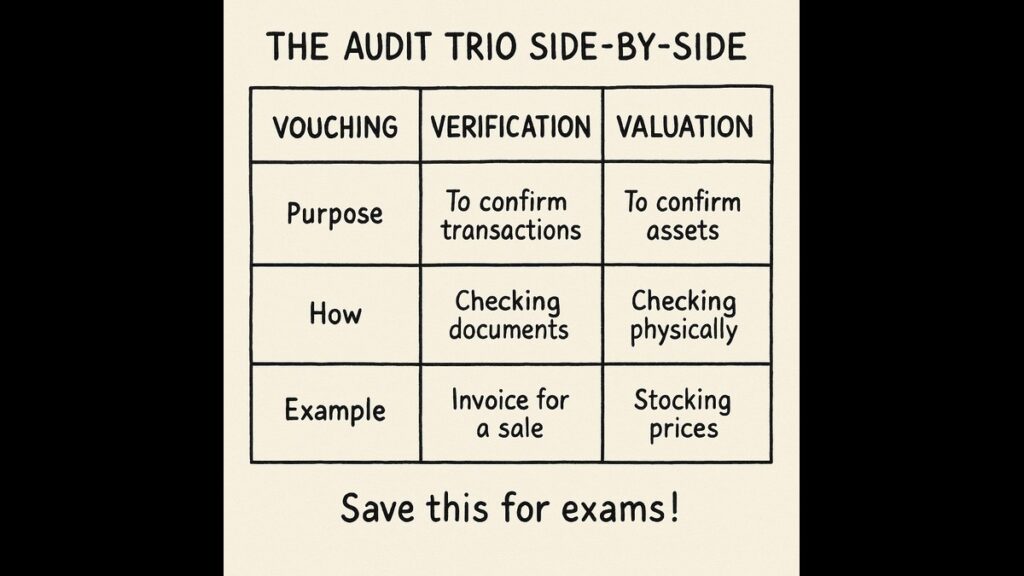

📊 Quick Comparison: Your Exam Cheat Sheet

Place: After all 3 sections

| Procedure | Main Question | Life Example | Tools |

|---|---|---|---|

| Vouching | “Where’s the proof?” | Checking project bills | Invoices, receipts |

| Verification | “Does this exist?” | Verifying lab equipment | Physical visit |

| Valuation | “What’s it worth now?” | Selling old phone | Market reports |

🎓 Why YOU Need to Know This

- Exams: 70% of audit practical questions

- Scams: Satyam scandal involved valuation fraud

- Daily Life:

- Vouching → Checking Zomato bill

- Verification → Inspecting used bike

- Valuation → Selling old books

- Career: Essential for CA, CMA, ACCA

✅ Key Takeaways

- Vouching = Paper proof check (“Show receipts!”) 📃

- Verification = Physical existence test (“Prove it’s real!”) 👀

- Valuation = Correct pricing (“What’s current value?”) ₹

- Together = Complete financial truth 🔍

📚 Student Success Kit

Study Hacks:

- Memory Trick: VVV = Verify Paper → Visit Place → Value Properly

- Exam Focus:

- Vouching → Sales/Purchases

- Verification → Fixed Assets

- Valuation → Inventory/Investments

Career Paths:

- Auditor (₹5-12L starting)

- Valuation Analyst

Free Resources:

- YouTube: “Vouching in 90 Seconds”

- Download: “Audit Procedures Poster” (link)