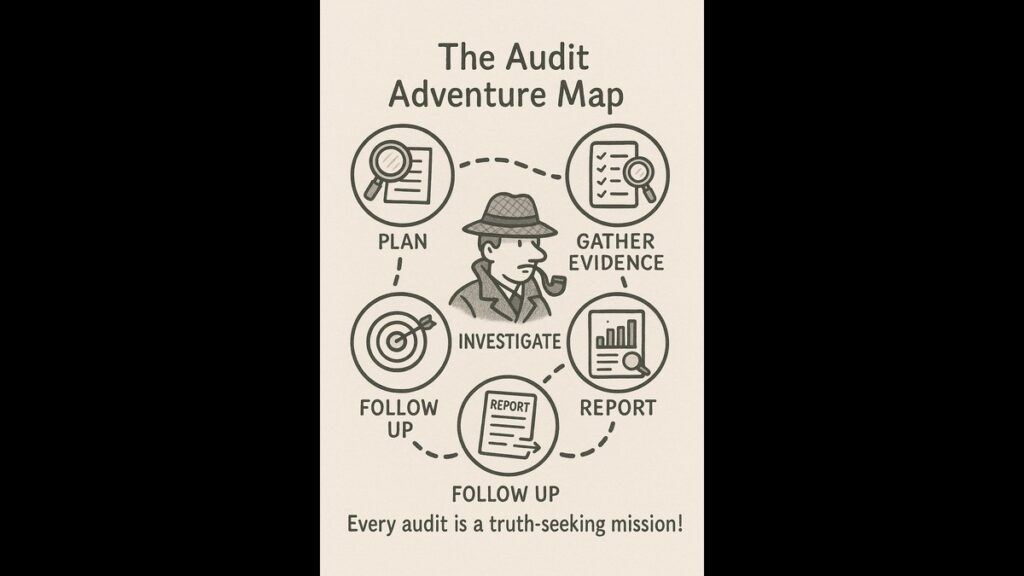

🌟 Intro: Think Like a Movie Detective!

Imagine you’re solving a mystery:

🕵️♂️ Get clues → Check alibis → Prove your case → Announce the truth

That’s exactly what auditors do! Let’s break down their detective work step-by-step.

🗓️ Step 1: Planning (The “Game Plan”)

“Like planning your exam study schedule!”

What happens:

- Auditor meets the company (“Suspect”)

- Asches: “Where could mistakes or fraud hide?”

- Flags risky areas (e.g., cash transactions, inventory)

Real Example:

Planning for a restaurant audit → Focus on cash sales (easy to hide) and food inventory (spoils quickly).

Why it matters:

✅ Good plan = Saves time, catches big issues

❌ No plan = Misses important clues

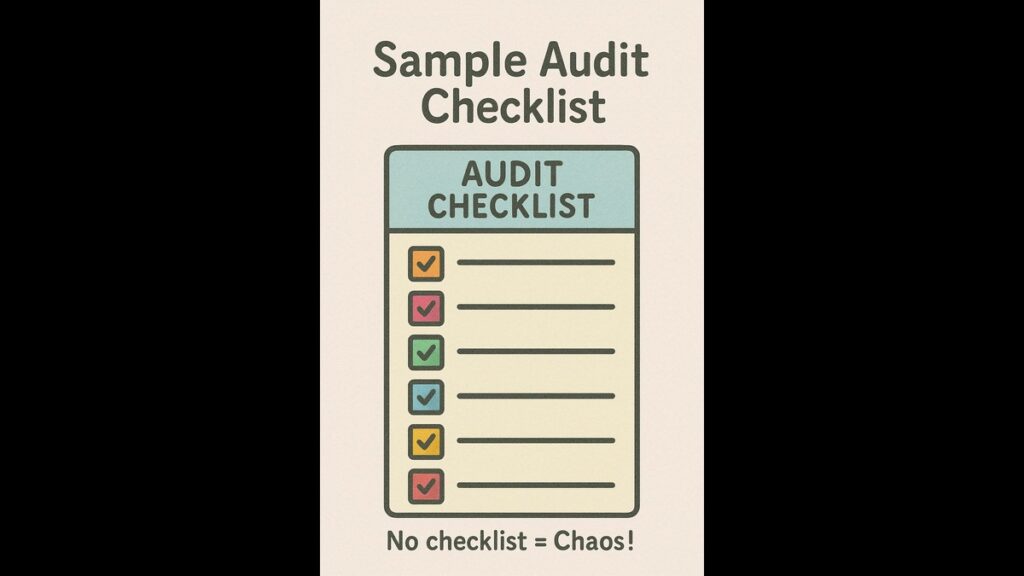

📝 Step 2: Audit Programme (The “To-Do List”)

“Your exam revision checklist!”

What it is: A simple task list:

plaintext

Copy

Download

1. Check cash register - Priya (by 15th) 2. Verify inventory - Raj (by 20th) 3. Review supplier bills - Amit (by 25th)

Key features:

- Clear deadlines 🕒

- Team responsibilities 👥

- How to test each item (e.g., check 30% of invoices)

🔎 Step 3: Vouching & Verification (The “Fact-Check”)

Two simple tools:

| Vouching | Verification |

|---|---|

| “Checking paper trails” | “Physical inspection” |

| ▶️ Match invoices to bank statements | ▶️ Count cash, scan inventory tags |

| 🎯 Catches fake transactions | 🎯 Confirms assets exist |

Student Analogy:

Vouching = Cross-checking notes with textbook

Verification = Checking lab equipment actually works

📓 Step 4: Working Papers (The “Secret Diary”)

“Your rough notebook during exams!”

What it contains:

- Photocopies of key documents

- Checklists with ✅/❌

- Private notes and calculations

Why auditors need it:

- Proof they did their work properly

- Memory aid for next year’s audit

- Legal protection if questioned

Golden Rule:

🔒 Never shown to clients!

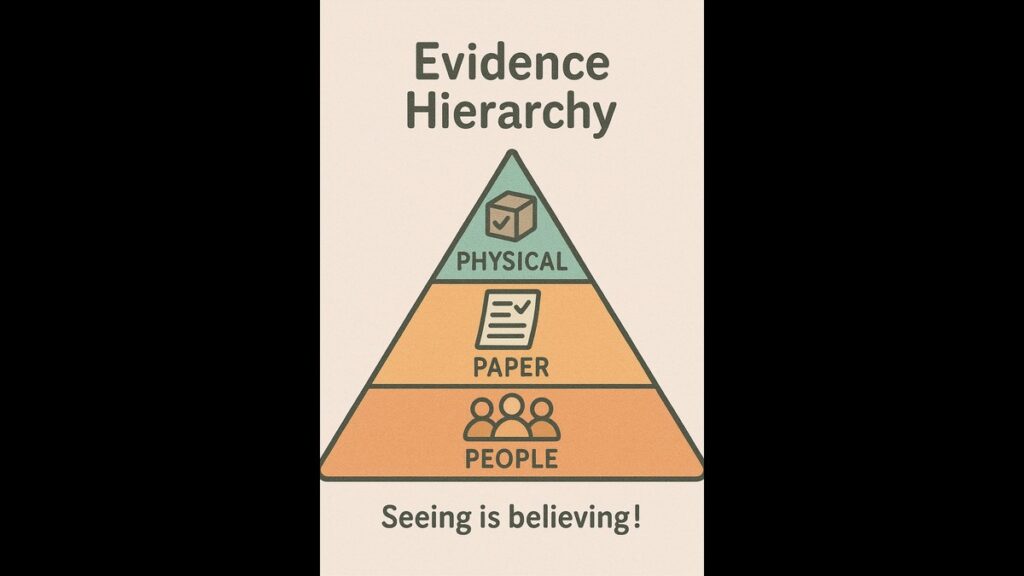

📸 Step 5: Evidence Collection (The “Proof Album”)

Auditors need solid proof like:

| Evidence Type | Everyday Example |

|---|---|

| Paper Proof | Signed receipts, contracts |

| Digital Proof | Bank transfer screenshots |

| People Proof | Staff interviews |

| Eye Proof | Seeing inventory yourself |

Evidence Rule:

🚨 “If you can’t prove it, it doesn’t count!”

📜 Step 6: Audit Report (The “Final Verdict”)

“Your exam results – but for companies!”

4 Possible Opinions:

- 👍 Clean Chit: “All good!”

- ⚠️ Qualified: “Good except [one issue]…”

- 👎 Adverse: “This is wrong!”

- ❓ Disclaimer: “Can’t decide (not enough info)”

Real Report Snippet:

“We found ₹5 lakh of missing inventory. Except for this, the accounts are accurate.”

➡️ This is a QUALIFIED OPINION

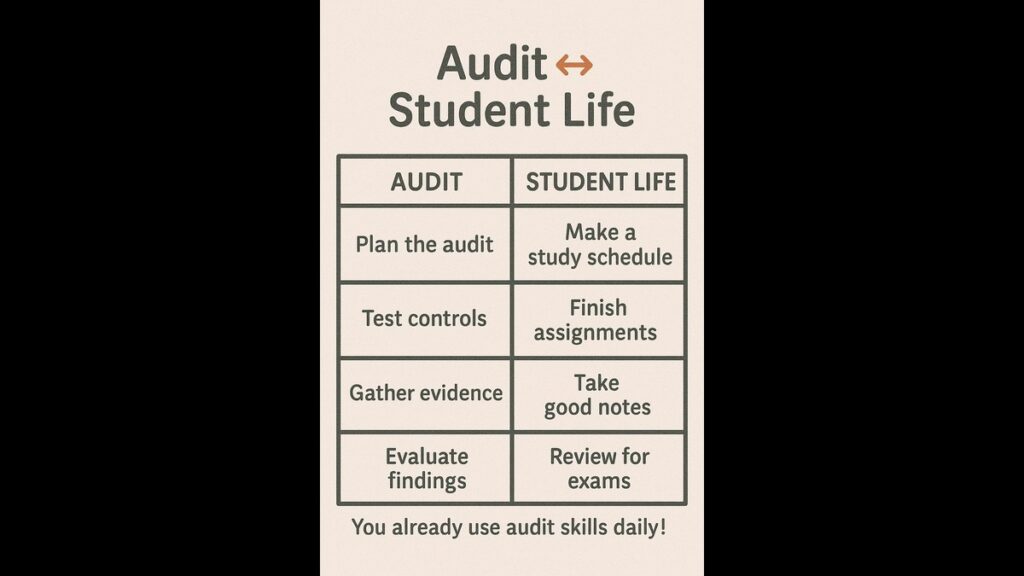

📊 Infographic: The Audit Journey

Place: After Step 6

| Stage | Student Version | Audit Version |

|---|---|---|

| Planning | Exam study schedule | Risk assessment |

| Programme | Revision topics list | Task checklist |

| Vouching | Cross-checking notes | Matching invoices |

| Evidence | Highlighting textbooks | Collecting documents |

| Report | Writing exam answers | Issuing audit opinion |

✅ Key Takeaways

- Planning is half the battle – Know where to look!

- Vouching catches lies – Paper doesn’t lie!

- Evidence is king – No proof = No opinion

- Reports tell truth – Companies live/die by them

💡 Pro Tip: “Working papers are your superhero cape – they protect you!”

📚 Student Success Kit

For Exams:

- Memorize the 6 steps (use acronym: P-VERD = Planning, Vouching, Evidence, Report, Documentation)

- Focus on differences between vouching vs verification

For Career:

- Auditors need attention to detail (like checking your exam paper twice!)