Why Do We Need Accounting Rules?

Imagine playing cricket without rules – chaos, right? Accounting rules (Concepts & Conventions) are like cricket rules. They ensure everyone plays fair, records truthfully, and reports consistently. Without them:

- Banks couldn’t trust loan applications.

- Investors couldn’t compare companies.

- You couldn’t track your business profits!

✅ They give us:

✔️ Trust (no fake numbers!)

✔️ Consistency (compare this year vs. last year)

✔️ Clarity (everyone speaks the same “accounting language”)

Part 1: 8 Core Accounting Concepts (The “Why”)

Concepts are the FOUNDATION of accounting.

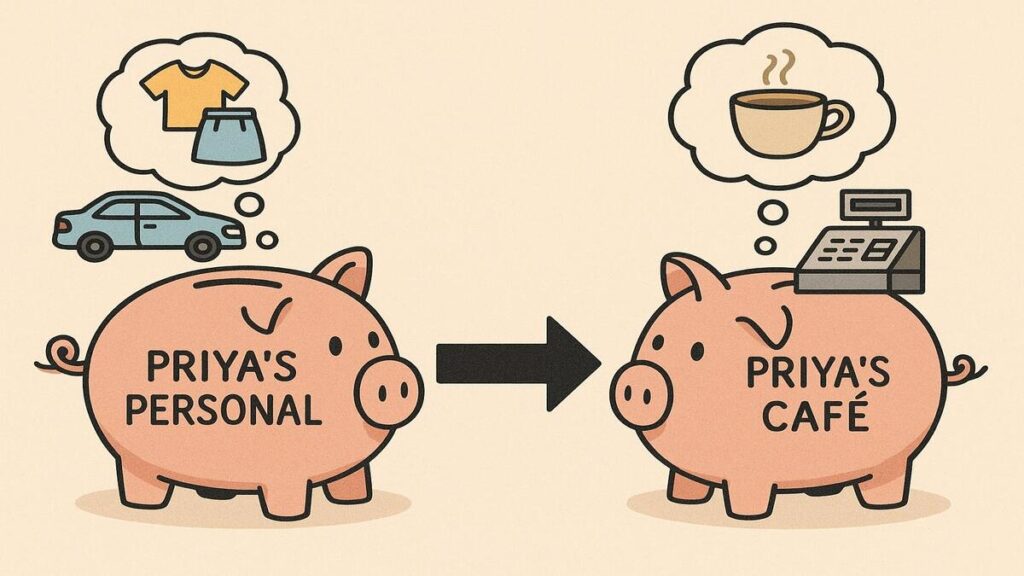

1. Business Entity Concept

“Keep Business & Personal Separate!”

- Meaning: Your business is a separate “person” from you.

- Example: Priya starts Priya’s Café with ₹1,00,000 from her savings.

→ Accounting Action: ₹1,00,000 is NOT Priya’s money anymore – it’s Café’s Capital. If Priya takes ₹10,000 for shopping, it’s “Drawings” (not Café’s expense). - Why? Prevents mixing personal groceries with café expenses!

2. Money Measurement Concept

“If You Can’t Count It in Money, Skip It!”

- Meaning: Only record transactions with ₹/$ value.

- Example:Priya’s Café has:

- A loyal customer base (priceless!)

- A prime location (super valuable!)

→ Accounting Action: Only records rent paid for the location (₹20,000/month), NOT the “value” of location or customers.

- Why? Feelings can’t be measured!

3. Going Concern Concept

“Assume Your Business Won’t Die Tomorrow!”

- Meaning: We assume the business will run forever (unless proven otherwise).

- Example: Priya buys an ₹80,000 coffee machine (lasts 8 years).

→ Accounting Action: Records machine as an Asset. Spreads cost as Depreciation (₹10,000/year for 8 years).

→ If Café was closing: Record machine at fire-sale value (say ₹20,000). - Why? Avoids panic-selling values!

4. Accounting Period Concept

“Slice Time into Manageable Chunks!”

- Meaning: Break endless business life into months/years for reporting.

- Example: Priya needs monthly profit reports + annual taxes.

→ Accounting Action: Tracks April 2024 – March 2025 as one financial year. - Why? Can’t wait 100 years to see if you’re profitable!

5. Cost Concept

“Record What You PAID, Not What It’s WORTH Now!”

- Meaning: Assets = Price Paid (even if value changes).

- Example: Priya buys chairs for ₹50,000. Next year, similar chairs cost ₹70,000.

→ Accounting Action: Chairs still recorded at ₹50,000 (less depreciation). - Why? Market values change daily – cost is solid proof!

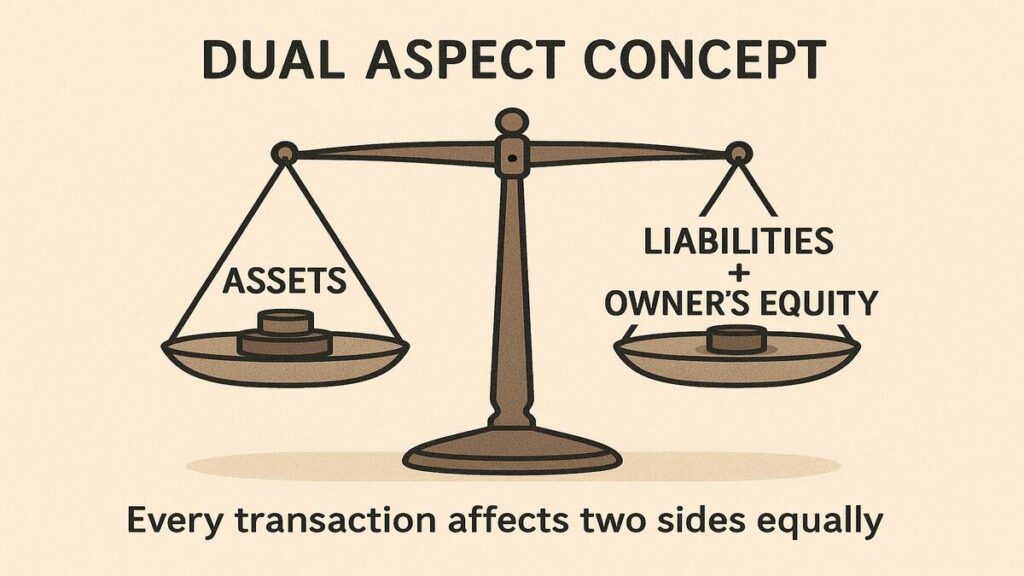

6. Dual Aspect Concept

“Every Transaction Has 2 Sides (Like a Coin)!”

- Meaning: Assets = Liabilities + Owner’s Equity (ALWAYS BALANCED!).

- Example: Priya invests ₹1,00,000 in her Café.

→ Effect 1: Café’s Cash (Asset) ↑₹1,00,000

→ Effect 2: Priya’s Capital (Owner’s Equity) ↑₹1,00,000 - Why? The backbone of double-entry bookkeeping!

7. Realisation Concept

“Record Income When EARNED, Not When Cash Comes!”

- Meaning: Income = When service/good is DELIVERED.

- Example: Priya caters a wedding on March 28 (year ends March 31). Payment comes April 5.

→ Accounting Action: Records Income in MARCH (when service done). Records Receivable (Asset). - Why? Matches income to the month you worked for it!

8. Matching Concept

“Match Expenses to the Income They Helped Earn!”

- Meaning: Expenses tied to income in the SAME PERIOD.

- Example: In March, Priya uses ₹15,000 of coffee beans to earn ₹50,000.

→ Accounting Action: Records ₹15,000 expense in MARCH (not when beans bought). - Why? Shows TRUE profit for March!

Part 2: 4 Key Accounting Conventions (The “How”)

Conventions are the “common-sense habits” accountants follow.

1. Consistency Convention

“Don’t Change Rules Mid-Game!”

- Meaning: Use same accounting methods yearly.

- Example: Priya uses Straight-Line Depreciation for her coffee machine.

→ Convention: She CAN’T switch to Reducing Balance Method next year to show higher profit. - Why? Allows fair year-to-year comparisons.

2. Disclosure Convention

“Tell the Whole Truth!”

- Meaning: Reveal all important info in financial statements.

- Example: Priya’s Café is sued for ₹2 lakh (case pending).

→ Convention: Disclose lawsuit details in “Notes to Accounts”, even if loss isn’t recorded yet. - Why? Hiding truths = Broken trust!

3. Materiality Convention

“Don’t Sweat the Small Stuff!”

- Meaning: Ignore tiny errors; focus on big-impact items.

- Example: Priya buys a ₹500 pen for the café (lasts 2 years).

→ Convention: Expense full ₹500 NOW (instead of ₹250/year depreciation). - But: A ₹80,000 fridge? Depreciate it!

- Why? Saves time & effort for trivial sums.

4. Conservatism Convention

“Expect Losses, But Don’t Dream of Gains!”

- Meaning:

- Record possible losses immediately.

- Record gains ONLY when certain.

- Example:

- Loss: Priya’s milk stock (cost ₹10,000) spoils → value now ₹2,000. Record ₹8,000 loss NOW.

- Gain: Café’s property value ↑₹5 lakh. Ignore gain until sold.

- Why? Avoid over-optimistic reports!

I

Why Should You Care?

- Students: Exams love these concepts!

- Entrepreneurs: Avoid accounting mistakes.

- Investors: Spot fake reports.

- Managers: Make profit-driven decisions.

Let’s Recap!

| Concept/Convention | Key Idea | Real-Life Shortcut |

|---|---|---|

| Business Entity | You ≠ Your Business | Separate bank accounts! |

| Money Measurement | Only ₹ matters | Skip “brand value” in books! |

| Going Concern | Assume business lives forever | Depreciate assets! |

| Accounting Period | Report yearly/monthly | File taxes on time! |

| Cost Concept | Record purchase price | Ignore market value changes! |

| Dual Aspect | 2 sides per transaction | Assets = Liabilities + Capital! |

| Realisation | Income when earned | Bill clients when work done! |

| Matching | Match costs to income | Record expenses when sales happen! |

| Consistency | Same rules yearly | Don’t switch depreciation methods! |

| Disclosure | Share all critical info | Disclose lawsuits/risks! |

| Materiality | Ignore small errors | Expense ₹500 pens immediately! |

| Conservatism | Record losses early | Write off spoiled stock immediately! |

Final Thought

Accounting concepts & conventions aren’t just textbook rules – they’re the GPS for financial decisions. Learn them once, and you’ll decode balance sheets like a pro!