(Perfect for FYBCom, BBA, and Accounting Students)

What are Final Accounts? Think Report Card 📝

Imagine your business is like your college semester:

- Trading Account = Your subject-wise marks

- P&L Account = Your final CGPA

- Balance Sheet = Your overall academic status

Final Accounts = Financial Report Card showing yearly performance!

✅ Why Adjustments?

Like correcting exam answers – we add forgotten items (unpaid rent, unsold stock) to show true results!

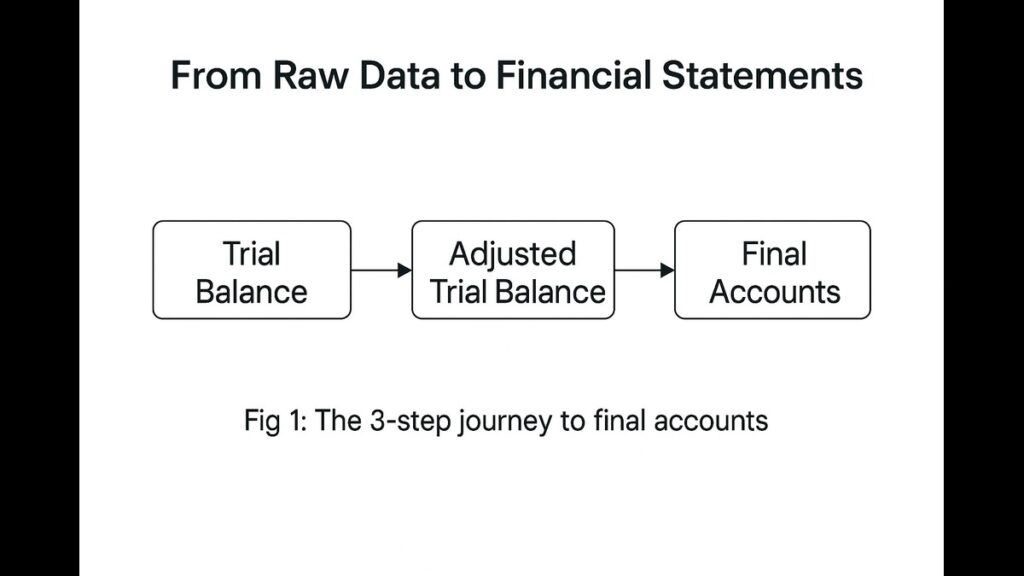

Image 1: Final Accounts Flow

Step 1: Trading Account (Your “Gross Profit Calculator”)

What it does:

Calculates profit from buying and selling goods.

Simple Formula:

text

Copy

Download

Gross Profit = Sales - Cost of Goods Sold

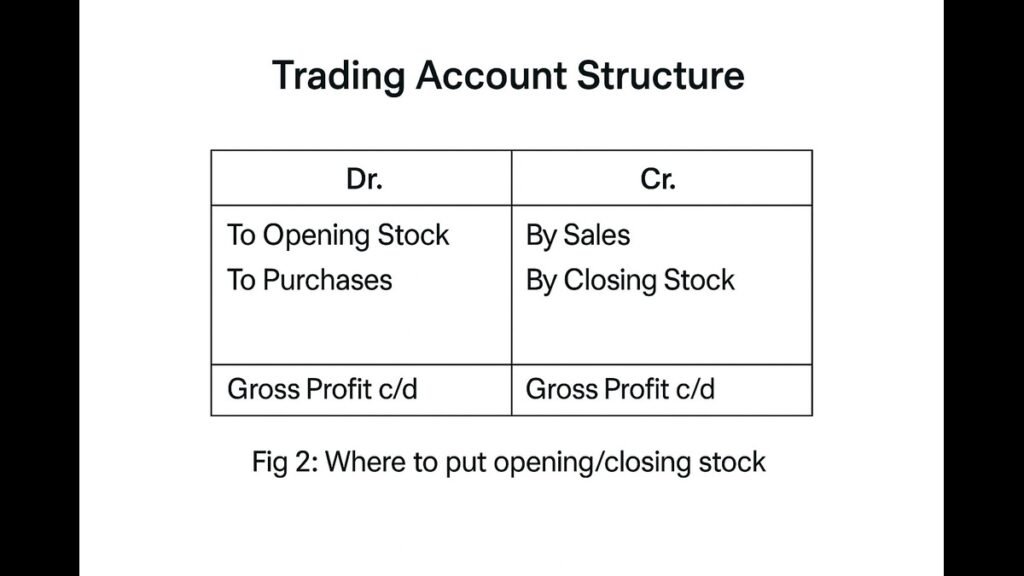

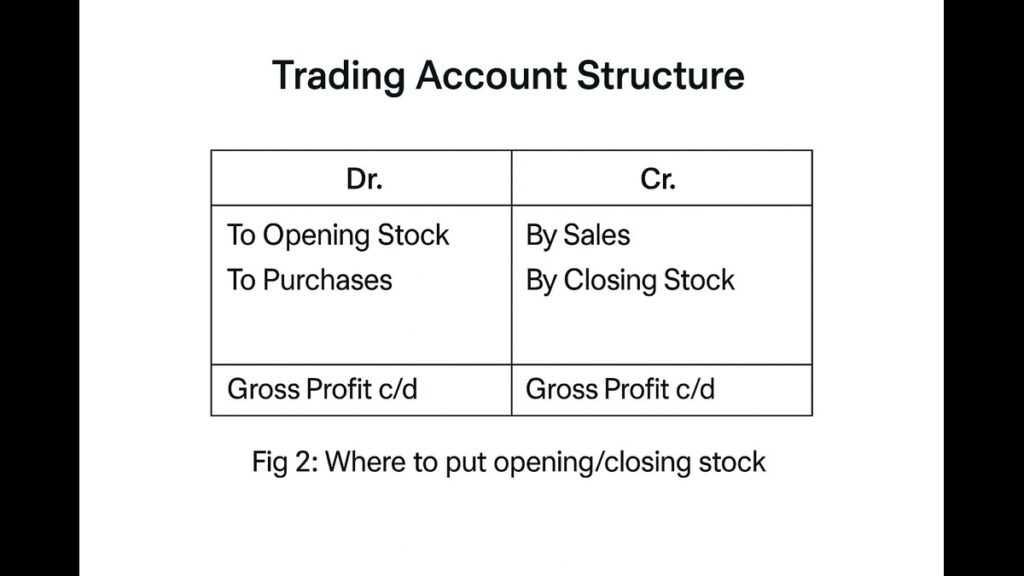

What goes inside?

| Debit Side (Costs) | Credit Side (Income) |

|---|---|

| • Opening Stock | • Sales |

| • Purchases | • Closing Stock (Adjustment!) |

| • Direct Expenses |

Key Adjustment:

- Closing Stock: Value of unsold goods → Add to credit side

💡 Example:

Bought goods ₹50,000, Sold for ₹80,000, Unsold stock ₹10,000

Gross Profit = 80,000 – (50,000 – 10,000) = ₹40,000

Image 2: Trading Account Format

Step 2: Profit & Loss Account (Your “Net Profit Finder”)

What it does:

Calculates final profit after all expenses.

Simple Formula:

text

Copy

Download

Net Profit = Gross Profit + Other Income - All Expenses

Common Adjustments:

| Adjustment | Where to Put |

|---|---|

| Outstanding Rent | Add to Expenses |

| Prepaid Insurance | Reduce Expenses |

| Depreciation | Add to Expenses |

| Bad Debts | Add to Expenses |

Image 3: P&L Account Format

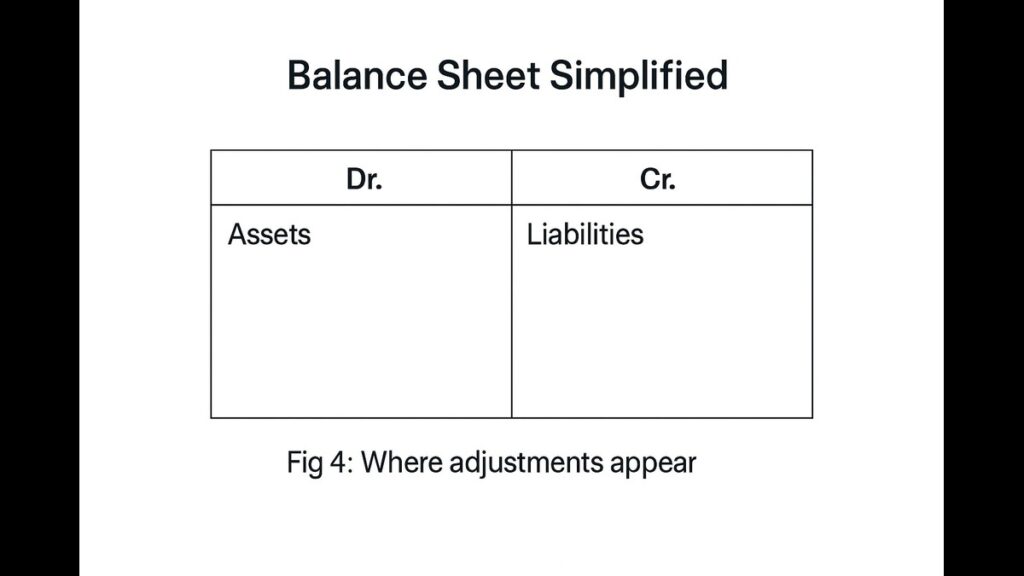

Step 3: Balance Sheet (Your “Financial Selfie” 📸)

What it shows:

- What you OWN (Assets)

- What you OWE (Liabilities)

- Your NET WORTH (Capital)

Adjustment Impact:

| Adjustment | Balance Sheet Effect |

|---|---|

| Closing Stock | Asset ↑ |

| Outstanding Rent | Liability ↑ |

| Prepaid Insurance | Asset ↑ |

| Depreciation | Asset ↓ |

Image 4: Balance Sheet Format

5 Must-Know Adjustments (With Examples)

- Closing Stock (₹20,000 not recorded)textCopyDownloadClosing Stock A/c Dr. 20,000 To Trading A/c 20,000 → Adds to Trading Cr. & Balance Sheet Asset

- Outstanding Salary (₹15,000)textCopyDownloadSalary A/c Dr. 15,000 To Outstanding Salary A/c 15,000 → Adds to P&L Expense & Liability

- Depreciation (10% on ₹1,00,000 Machinery)textCopyDownloadDepreciation A/c Dr. 10,000 To Machinery A/c 10,000 → Adds to P&L Expense & Reduces Asset Value

- Prepaid Rent (₹5,000)textCopyDownloadPrepaid Rent A/c Dr. 5,000 To Rent A/c 5,000 → Reduces Rent Expense & Becomes Asset

- Bad Debts (Customer won’t pay ₹8,000)textCopyDownloadBad Debts A/c Dr. 8,000 To Debtors A/c 8,000 → Adds to P&L Expense & Reduces Debtors

Pizza Shop Example 🍕

Trial Balance:

- Sales: ₹3,00,000

- Purchases: ₹1,80,000

- Rent: ₹24,000

Adjustments:

- Closing Stock: ₹40,000

- Rent Prepaid: ₹4,000

- Equipment Depreciation: ₹10,000

Solution:

Trading Account:

| Expenses | ₹ | Income | ₹ |

|---|---|---|---|

| Purchases | 1,80,000 | Sales | 3,00,000 |

| Gross Profit c/d | 1,60,000 | Closing Stock | 40,000 |

| Total | 3,40,000 | Total | 3,40,000 |

P&L Account:

| Expenses | ₹ |

|---|---|

| Rent (24k-4k) | 20,000 |

| Depreciation | 10,000 |

| Net Profit | 1,30,000 |

Balance Sheet:

| Assets | ₹ | Liabilities | ₹ |

|---|---|---|---|

| Closing Stock | 40,000 | Capital | XXXX |

| Prepaid Rent | 4,000 | Add: Net Profit | 1,30,000 |

| Equipment (Net) | 90,000 |

Image 5: Adjustment Impact

3 Golden Rules for Exams ✨

- Closing Stock:

- Trading Account (Credit side)

- Balance Sheet (Asset)

- Prepaid Expenses:

- Deduct from expense in P&L

- Show as Asset in Balance Sheet

- Depreciation:

- Add to P&L Expenses

- Deduct from Asset value

💡 Pro Tip:

Create a checklist:

“Did I remember Closing Stock? Outstanding Expenses? Depreciation?”

Why This Matters?

- 50% of your accounting exam marks

- Used by real businesses every month

- Foundation for CA/CMA/CS courses

Conclusion

Master final accounts with adjustments to:

- Score 90%+ in exams 📚

- Understand business finances 💼

- Build a great career in finance 🚀

Start Today: Solve 1 adjustment problem daily!