(Fix Accounting Mistakes Like a Pro!)

What are Accounting Errors?

Imagine writing ₹500 as ₹5,000 in your cash book. That’s an error! Rectification means fixing these mistakes before preparing financial statements.

Why it matters:

- Ensures accurate financial reports

- Prevents exam marks deduction 😉

- Builds good accounting habits

✅ Golden Rule:

Errors found before trial balance → Fix with journal entries!

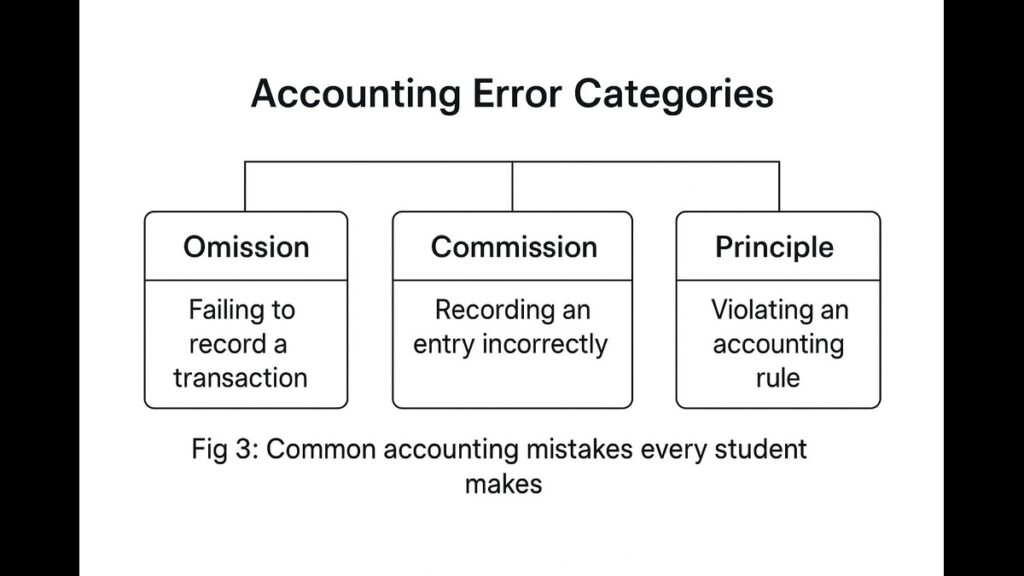

4 Common Error Types (with Examples)

| Error Type | What Happened? | Example |

|---|---|---|

| 1. Omission | Transaction not recorded | Forgot to enter ₹10,000 sale |

| 2. Commission | Wrong amount/account | Wrote ₹5,000 instead of ₹500 |

| 3. Principle | Wrong accounting rule | Treated asset as expense |

| 4. Compensating | Two errors cancel out | ₹1,000 under debit + ₹1,000 over credit |

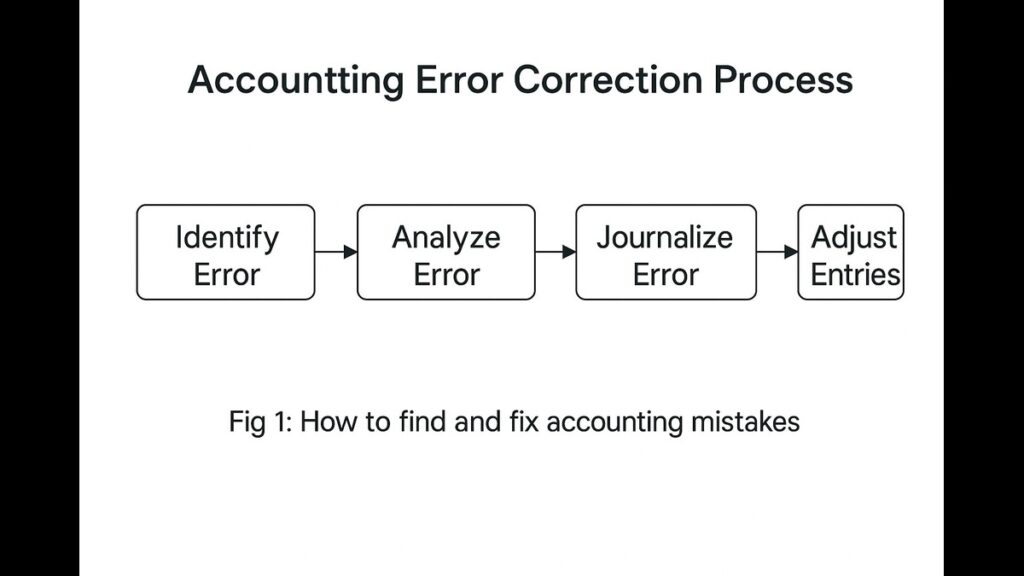

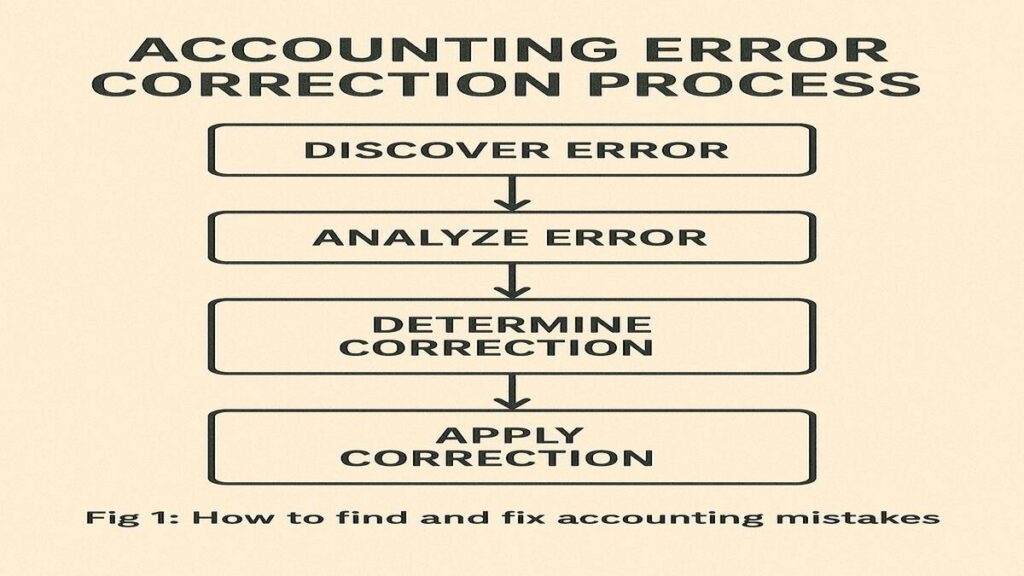

How to Rectify Errors? 3 Simple Steps

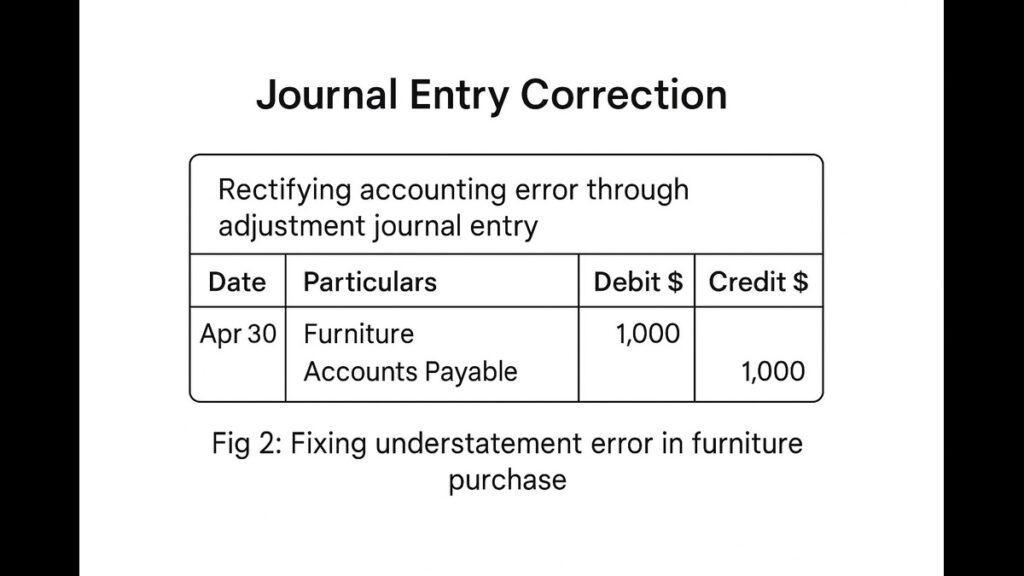

Scenario: Bought chairs for ₹15,000 cash, but recorded as ₹1,500.

Step 1: Identify Original Entry

text

Copy

Download

Wrong Entry: Furniture A/c Dr. ₹1,500 To Cash A/c ₹1,500

Step 2: Determine Correct Entry

text

Copy

Download

Correct Entry: Furniture A/c Dr. ₹15,000 To Cash A/c ₹15,000

Step 3: Pass Rectification Entry

text

Copy

Download

Furniture A/c Dr. ₹13,500 (15,000 - 1,500) To Cash A/c ₹13,500

(Adds missing ₹13,500 to Furniture and reduces Cash)

Error-Specific Fixes (With Journal Entries)

Case 1: Omission Error

Mistake: Forgot to record ₹20,000 credit sales to Raj.

Fix:

text

Copy

Download

Raj's A/c Dr. ₹20,000 To Sales A/c ₹20,000

Case 2: Commission Error

Mistake: Wrote ₹7,000 instead of ₹700 for stationery.

Fix:

text

Copy

Download

Stationery A/c Cr. ₹6,300 (7,000 - 700) To Cash A/c ₹6,300

(Reduces excess debit in Stationery)

Case 3: Principle Error

Mistake: Treated laptop purchase (asset) as expense.

Original Wrong Entry:

text

Copy

Download

Repairs A/c Dr. ₹50,000 To Cash A/c ₹50,000

Fix:

text

Copy

Download

Laptop A/c Dr. ₹50,000 To Repairs A/c ₹50,000

Image 3: Error Types Visual

Solved Problems (Test Yourself!)

Problem 1: Paid ₹8,000 rent, but recorded as ₹800.

Rectification Entry:

text

Copy

Download

Rent A/c Dr. ₹7,200 (8,000 - 800) To Cash A/c ₹7,200

Problem 2: Sold goods to Meena ₹12,000, but not recorded.

Rectification Entry:

text

Copy

Download

Meena's A/c Dr. ₹12,000 To Sales A/c ₹12,000

Problem 3: Machinery repairs ₹10,000 debited to Machinery A/c.

Fix:

text

Copy

Download

Repairs A/c Dr. ₹10,000 To Machinery A/c ₹10,000

Pro Tips for Error-Free Accounting

- Recheck entries daily

- Use pencil for first-time entries

- Verify totals with calculator

- Learn common errors:

- Swapping debit/credit

- Transposing numbers (58 vs 85)

💡 Exam Hack:

When rectifying, always mention:

“Being rectification of error in…”

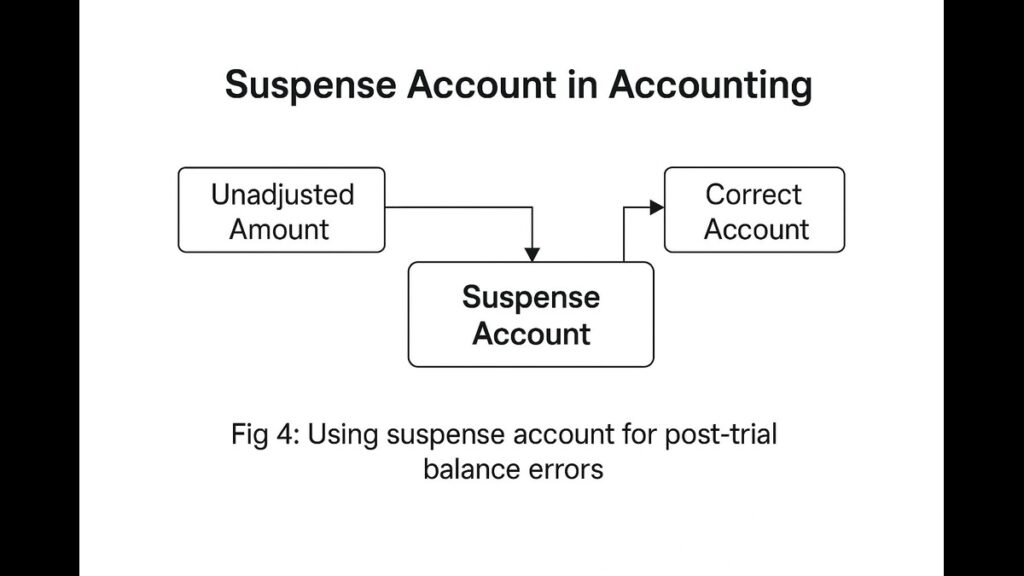

When Errors Slip Through?

If found after financial statements:

- Adjust in next year’s accounts

- Use “Suspense Account”

text

Copy

Download

Suspense A/c Dr. XXX To Correct A/c XXX

Conclusion

Master error rectification to:

- Score higher in exams 📚

- Avoid real-world accounting blunders 💼

- Become a detail-oriented professional 🎯

Final Tip: Practice 2 rectification problems daily for 1 week!