📘 What is Transfer Pricing?

When a multinational company (MNC) operates in more than one country, it often sells goods, services, or intellectual property between its own branches (called related entities).

The price charged in these internal transactions is called Transfer Price.

👉 The system of deciding that price is called Transfer Pricing.

🧾 Why is Transfer Pricing Important?

Transfer pricing affects how much profit is shown in each country — and this directly affects how much tax the company pays.

Example:

- A company sells a product from its USA unit to its Indian unit.

- If it keeps the transfer price low, most profit stays in India.

- If the price is high, more profit is shown in the USA.

That’s why tax authorities closely monitor these prices.

✍️ Simple Definition for Students

Transfer Pricing is the method used by multinational companies to decide the prices for goods or services traded between their own divisions in different countries.

🏛️ Who Regulates Transfer Pricing?

Governments want to make sure MNCs don’t use fake pricing to shift profits to low-tax countries.

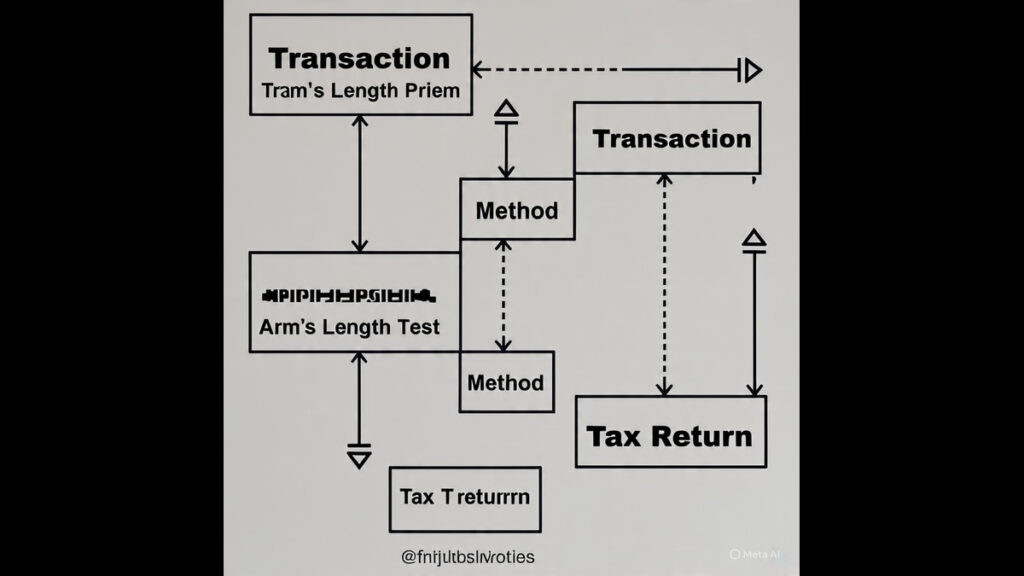

So, they apply Transfer Pricing Rules using the Arm’s Length Principle.

📏 What is the Arm’s Length Principle?

It means the price between related parties should be the same as it would be between independent companies in the open market.

This makes sure the company pays the right amount of tax in each country.

🔍 Methods Used in Transfer Pricing

According to OECD Guidelines and Indian Tax Law, the following methods are used:

| Method | Description |

| Comparable Uncontrolled Price (CUP) | Compare with price charged in an independent transaction |

| Resale Price Method | Start from resale price and subtract margins |

| Cost Plus Method | Add a profit margin to the cost incurred |

| Transactional Net Margin Method (TNMM) | Net profit margin comparison |

| Profit Split Method | Split total profits among related parties fairly |

🇮🇳 Transfer Pricing in India

- Indian law follows Section 92 to 92F of Income Tax Act, 1961

- Applies to international transactions between Associated Enterprises (AEs)

- Companies must maintain documentation and use approved methods

⚠️ What Happens If a Company Breaks Transfer Pricing Rules?

- Tax authorities can recalculate profits

- Company may face:

- Tax penalties

- Interest

- Reputational damage

- Tax penalties

🎯 Why Do MNCs Manipulate Transfer Pricing?

📉 To reduce global tax burden

🌍 To shift profit from high-tax to low-tax countries

💸 To maximize group-level profits

🎓 Why Students Must Learn This

- UGC NET, SET, MBA & M.Com often include questions on this topic

- Helps in case study writing and taxation papers

- Relevant for corporate law, accounting, and finance exams

- Transfer pricing is one of the most frequently tested topics in international taxation

📚 Must-Know Keywords for Exams & SEO

| Term | Meaning |

| Transfer Pricing | Internal pricing between related entities of a company |

| Arm’s Length Price | Market-based price between unrelated companies |

| Associated Enterprise (AE) | Related party in another country |

| OECD Guidelines | Global standards for fair transfer pricing |

| TNMM | Common method used in India for setting transfer price |

🧠 Quick Recap

✅ Transfer pricing decides the internal price between related companies

✅ Affects tax paid in each country

✅ Must follow arm’s length principle

✅ India has strict rules and methods

✅ MNCs may misuse it to lower tax

✅ You must understand this if you’re a commerce student

✅ Conclusion

Transfer Pricing is not just an advanced tax concept — it is a real-world issue that affects governments, companies, and economies.If you’re a student of Commerce, Taxation, or International Business, understanding Transfer Pricing gives you a clear edge in exams and your career