(Perfect for FYBCom, B.Com, M.Com, BBA, BBM, MBA, PGD & UGC NET/SET Students)

🧾 Introduction: Why Should You Learn Financial Accounting?

If you’re a commerce student, Financial Accounting is like your ABCD of business studies.

Before learning GST, Audit, or Costing — you must know how to record basic transactions.

Whether you’re in FYBCom, doing M.Com or MBA, or preparing for NET/SET Commerce, financial accounting forms the foundation of your entire commerce education.

This blog will help you clearly understand:

- ✅ What is Financial Accounting?

- ✅ What are its key features?

- ✅ Why is it important for students & businesses?

📌 Meaning of Financial Accounting

Financial Accounting is the systematic process of recording all the financial transactions of a business in a structured and understandable manner.

It involves:

- ✍️ Recording transactions (like cash received, goods sold, salaries paid)

- 📚 Classifying them into various accounts (like Cash A/c, Sales A/c, Salary A/c)

- 🧮 Summarizing into final accounts (like Profit & Loss Account and Balance Sheet)

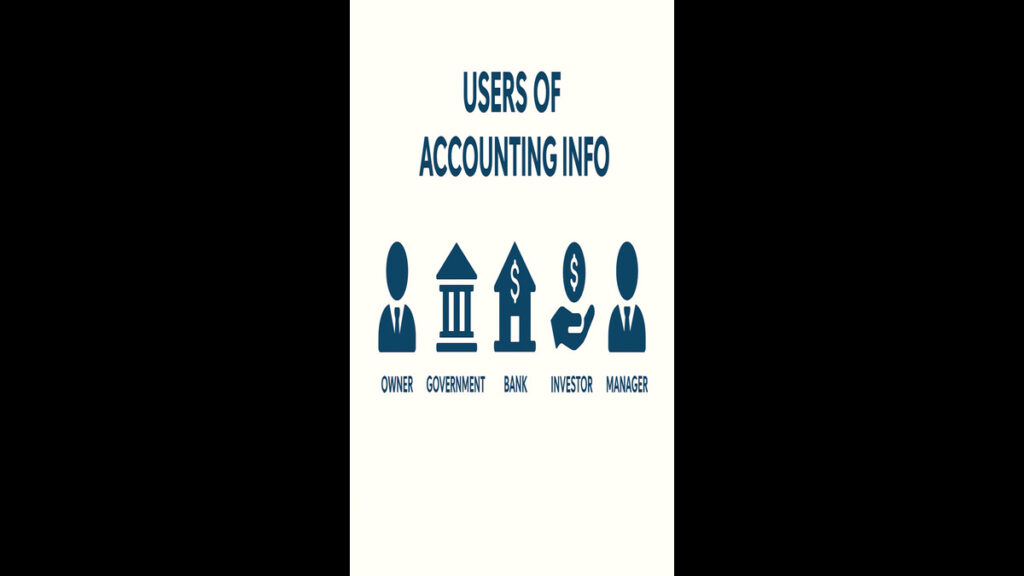

- 📢 Reporting results to owners, managers, investors, and government

📖 Example:

If a business sells goods for ₹10,000 cash, financial accounting ensures this is recorded properly in the Sales A/c and Cash A/c.

🎯 Features of Financial Accounting (Easy to Remember)

These are the most important points every student must understand:

- 📒 Records Historical Data

- It only records transactions that have already happened.

- 💵 Only Monetary Items Are Recorded

- You can’t record employee motivation, only salary paid.

- 🔁 Based on Double Entry System

- Every transaction affects two accounts – Debit and Credit.

- 📄 Follows Accounting Standards

- Governed by GAAP (Generally Accepted Accounting Principles) and AS (Accounting Standards)

- 🧾 Summarizes in Standard Reports

- Produces Trading Account, Profit & Loss Account, and Balance Sheet.

- 📊 Helps in Analysis & Decision Making

- Based on records, a business can decide whether to invest, expand, or cut costs.

🔎 Importance of Financial Accounting for Students

Why is this subject so important? Here’s how it helps:

✅ For Students:

- Makes concepts of advanced subjects (Taxation, Audit, Costing) easy to understand

- Frequently asked in FYBCom internal and university exams

- Appears in NET/SET Commerce MCQs

✅ For Businesses:

- Tracks income, expenses, and profit/loss

- Helps in taxation and government compliance

- Shows financial position to outsiders like banks and investors

- Used during auditing and legal assessments

📝 Let’s Simplify with a Real-Life Example

🎓 Imagine you’re running a small online bookshop:

You bought books worth ₹20,000 and sold them for ₹30,000. You paid ₹2,000 as rent.

In accounting terms:

- 📥 Purchases → ₹20,000 → Debited

- 📤 Sales → ₹30,000 → Credited

- 🧾 Rent → ₹2,000 → Debited

You earned a net profit of ₹8,000 (₹30,000 – ₹20,000 – ₹2,000).

Financial accounting will help you calculate and record all this properly.

🎓 Quick Exam Tip: How to Remember?

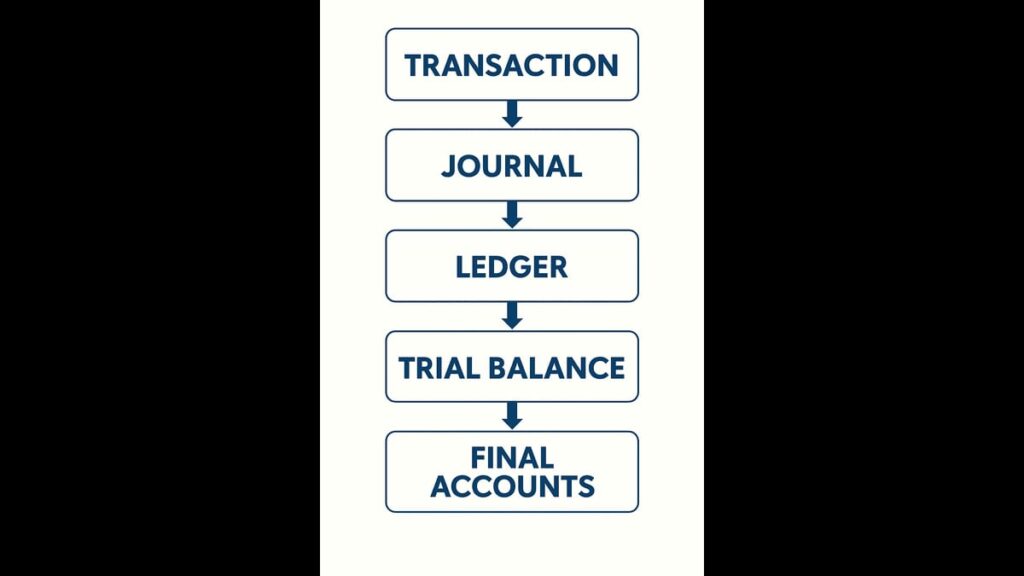

📌 Always remember the Accounting Process:

Transaction → Journal → Ledger → Trial Balance → Final Accounts

Make a chart in your notes. This is the most repeated question in internal exams and university papers.

🧠 Conclusion

Financial Accounting is not just a subject — it’s the language of business.

As a B.Com or PG student, you must understand:

- How transactions are recorded,

- How profit/loss is calculated,

- And how a business shows its financial position.

This subject is not only scoring but also forms the base of your future career in commerce — whether as a CA, CFO, accountant, or professor.

📩 Don’t forget to share this with your classmates & bookmark it for quick revision before exams!