📝 Introduction

In a globalized world, students, professionals, and businesses frequently earn income from foreign countries. But this often leads to double taxation — a situation where the same income is taxed in two countries.

To avoid this burden, countries sign treaties called Double Taxation Avoidance Agreements (DTAA). This blog is written in a simple and student-friendly way to help you understand DTAA clearly — ideal for B.Com., M.Com. BBA, BBM, MBA, NET/SET Commerce, PGD, and entrance exam aspirants.

📌 What is Double Taxation?

Double taxation happens when the same income is taxed in both the source country and the resident country.

Example:

An Indian student works part-time in Canada and earns $1,000.

- Canada taxes that income.

- India may also want to tax that same income if the student is a tax resident of India.

That’s double taxation — and it’s financially unfair.

📌 What is DTAA?

DTAA (Double Taxation Avoidance Agreement) is an international tax treaty between two countries. Its goal is to make sure you don’t pay tax twice on the same income.

India has signed DTAAs with over 90 countries, including:

- USA

- UK

- Germany

- UAE

- Australia

- Canada

These agreements help individuals, students, and companies to save on taxes and promote international economic activity.

✅ Benefits of DTAA for Students and Professionals

- Avoids double taxation of foreign income

- Promotes studying or working abroad

- Helps in competitive exams like UGC NET Commerce, SET, MBA entrances

- Useful in higher studies like M.Com, MBA, PGD

📌 Types of DTAA Relief

🔹 1. Exemption Method

- Income is taxed only in one country.

- The other country gives a full exemption.

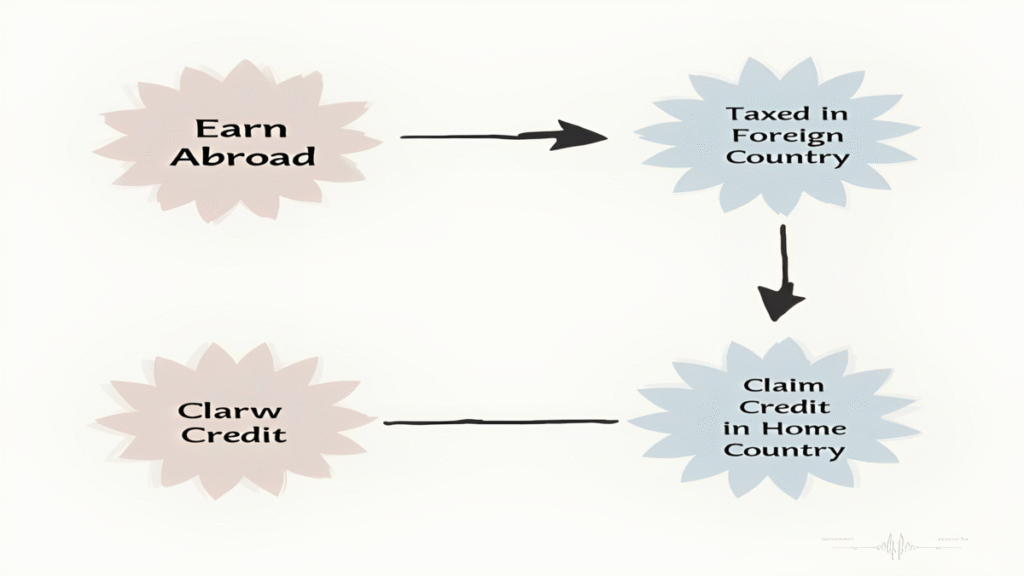

🔹 2. Tax Credit Method

- Income is taxed in both countries, but the resident country gives credit for the tax paid abroad.

Example:

If you paid $100 tax in the USA, India will deduct $100 from your Indian tax amount.

🧠 Important DTAA Terms

| Term | Meaning |

| Resident | Where you legally live and pay taxes |

| Source Country | Where the income is earned |

| Resident Country | Where the taxpayer resides |

🌍 Real-Life Example

An M.Com student goes to Germany and earns a monthly research stipend.

- Germany taxes this stipend.

- India, under the DTAA, will either exempt this income or provide tax credit, depending on the treaty terms.

🔍 SEO Keywords to Use in Blog & Images

Use these naturally in headings, image alt texts, meta description, and intro/conclusion:

- Double Taxation Avoidance Agreement for students

- DTAA simplified

- DTAA India treaty list

- DTAA for B.Com M.Com students

- Taxation for international students

- International taxation for NET Commerce

- UGC NET international taxation

- Tax credit vs exemption method

- DTAA between India and USA

- Commerce blog for college students

✅ Conclusion

Double Taxation Avoidance Agreements (DTAAs) are crucial for anyone earning across borders. They protect you from being taxed twice and are extremely important for students, professionals, and businesses involved in international work.

As commerce students or exam aspirants, learning DTAA gives you an academic edge and practical knowledge for your future career.