✨ Introduction

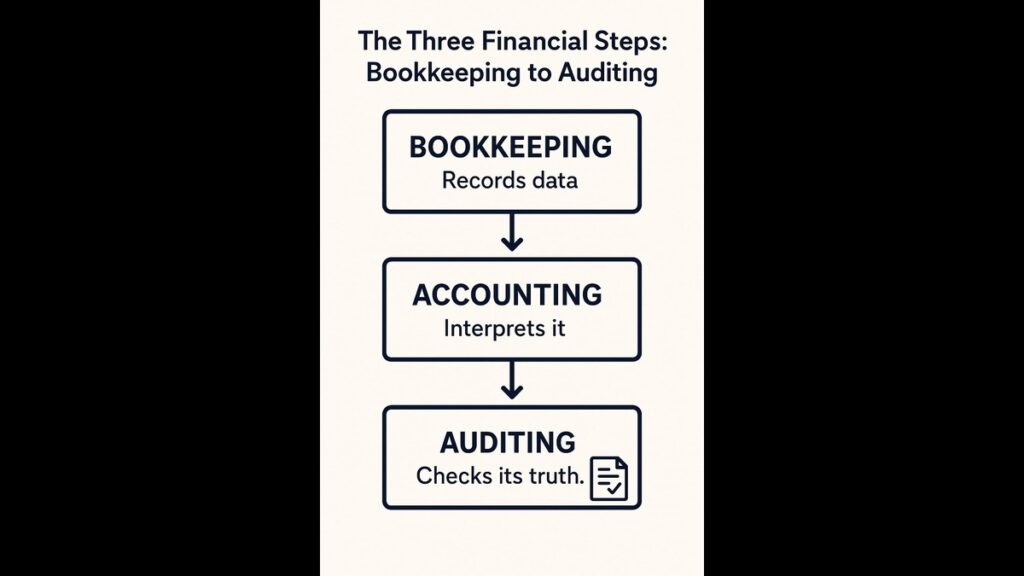

When you begin your journey as a commerce student, you’ll come across three terms again and again:

Bookkeeping, Accounting, and Auditing.

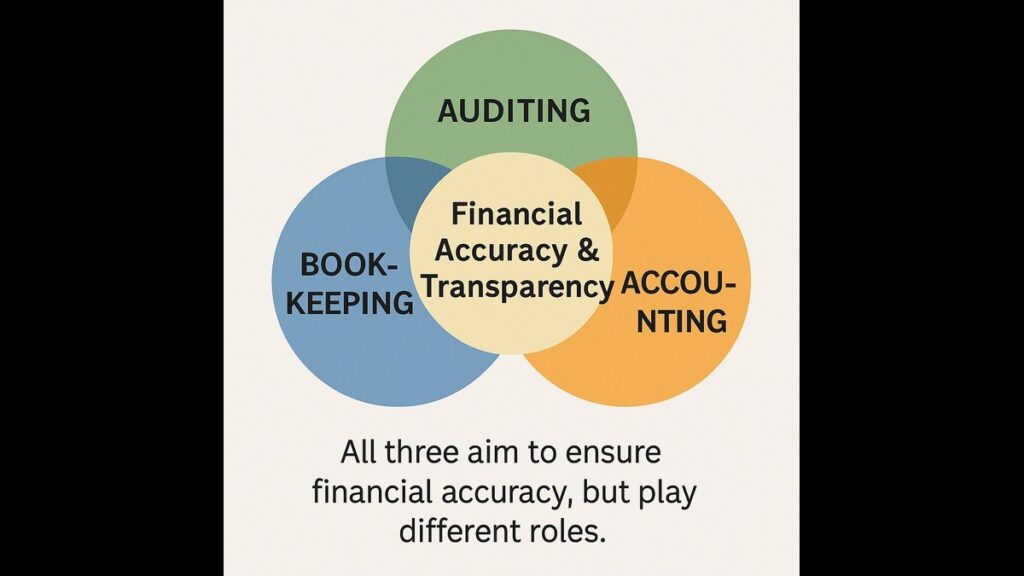

While they may sound similar and are all related to business and finance, they are very different in purpose, process, and responsibility.

Let’s break each one down in a way that is easy to understand, and then compare them with a useful table.

🧾 1. What is Bookkeeping?

Bookkeeping is the basic and initial step in the financial recording process. It means systematically recording all financial transactions that take place in a business.

It’s like writing every money-related activity in a proper notebook or software – without analysis or explanation.

✦ Key Features:

- Records daily financial transactions

- Involves documents like invoices, bills, receipts, and vouchers

- Maintains books like Journal, Cash Book, Ledger

- Mostly mechanical or routine work

- Focus is on accuracy and completeness, not decision-making

- Done by a bookkeeper or junior accountant

🧾 Example: Suppose a business pays ₹5,000 for electricity. The bookkeeper will simply record it in the cash book on that date – nothing more.

📊 2. What is Accounting?

Accounting begins where bookkeeping ends. It includes summarizing, interpreting, classifying, adjusting, and reporting the data that has already been recorded.

It turns raw transaction data into useful financial statements, helping the owners or managers understand how the business is doing.

✦ Key Features:

- Prepares Final Accounts (Profit & Loss A/c, Balance Sheet)

- Includes adjusting entries, depreciation, prepaid expenses, etc.

- Helps in decision-making and future planning

- Done by qualified accountants

- Follows specific principles and standards (like GAAP, Ind AS)

📊 Example: From hundreds of income and expense entries, an accountant prepares a Profit & Loss Account to see how much profit the business made in a year.

🔍 3. What is Auditing?

Auditing is the final step. It involves a careful check of the accounting records and financial statements by an independent auditor.

The goal is to ensure the statements show a “true and fair view” of the company’s financial position. Auditing detects errors, frauds, and misstatements.

✦ Key Features:

- Done after accounting is complete

- Conducted by a Chartered Accountant or external auditor

- Verifies compliance with legal rules and accounting standards

- Ends with an Audit Report

- Gives trust to owners, shareholders, banks, government, etc.

🔍 Example: After the accountant prepares the Balance Sheet, the auditor checks the calculations, vouchers, supporting documents and confirms if the final results are trustworthy.

📋 Comparison Table: Bookkeeping vs Accounting vs Auditing

| 🔍 Feature | 📒 Bookkeeping | 📈 Accounting | 🧾 Auditing |

|---|---|---|---|

| Meaning | Recording of all transactions | Classifying & summarizing data | Examining and verifying accounting records |

| Main Purpose | Maintain accurate records | Prepare reports for decision making | Confirm truthfulness & fairness of reports |

| Performed By | Bookkeeper | Accountant | Auditor (independent) |

| Nature of Work | Routine, day-to-day | Analytical, interpretative | Investigative, judgment-based |

| Stage in Process | First step | Second step | Final step |

| Legal Requirement | Usually not compulsory | Usually required | Compulsory for companies |

| End Product | Ledger, Trial Balance | Financial Statements | Audit Report |

| User of Result | Internal only | Owners, Managers | Shareholders, Government, Public |

| Time of Operation | Continuous (daily/monthly) | Monthly or Yearly | Year-end or quarterly |

| Focus | Accuracy of data entry | Business performance | Compliance, error detection |

📌 Summary Table for Quick Revision

| 📘 Concept | 🔧 What it Does | 👨💼 Who Does It |

|---|---|---|

| Bookkeeping | Records each transaction | Bookkeeper |

| Accounting | Analyzes and reports results | Accountant |

| Auditing | Verifies and certifies accuracy | Auditor (Independent) |

🎯 Why Should You Know the Difference?

Understanding these three terms is important not just for your exams, but also if you plan to:

- Become an accountant, auditor, or tax consultant

- Appear for CA, CS, CMA, MBA entrance exams

- Work in a business, bank, or finance company

In short, every commerce student should master these three building blocks of financial knowledge.

💬 Bonus Tip (Exam Edge!)

In your BCom exams, when you’re asked to “differentiate bookkeeping, accounting, and auditing”:

- Start with clear definitions

- Use a comparison table

- Add a small example for each

- End with a short conclusion

That structure alone can fetch you full marks!